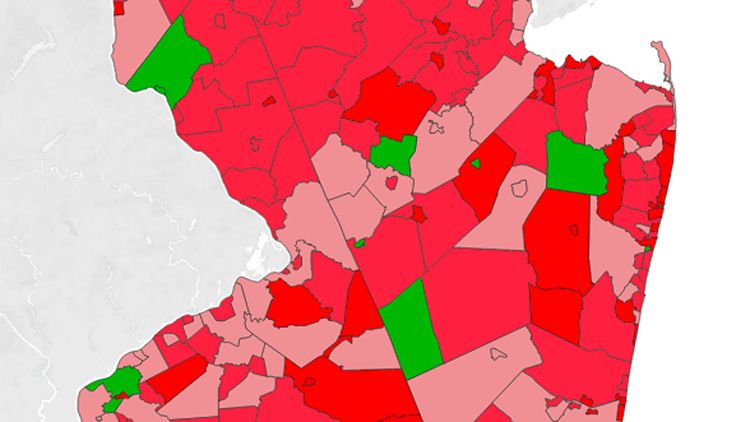

Tax Map Nassau County Ny – A tax map for the county is crucial for property owners and company owners. Knowing how to use a parcel maps, which are an essential component of the tax map for counties, will assist you to pay your taxes on time and keep the value.

Cartografting cadastral parcels

Cadastral parcel mapping plays a crucial role in the evaluation of real estate. It aids the assessor to locate each parcel and issue it with the Parcel Identification number.

This is accomplished by using the parcel’s form, dimensions as well as its location. This map shows the relationship between the parcels. The plots may be taxed or exempt from taxation.

The whole region that will be taxed is established throughout the tax mapping process. On the tax map, every piece of taxable property should be identified. It is essential to keep the map updated.

The dimensions of the parcel, or form must be updated, which necessitates modifying the tax map. When the number of parcels changes, adjustments are necessary.

A tax map shows the amount and whereabouts of every tax-exempt property within a particular county. Every local assessor is supplied with tax maps by the county. These maps are meant to aid the assessor with creating the roll of assessment.

Accuracy of parcels in the county

Numerous variables can impact the accuracy displayed on tax maps for counties. First, the data’s initial source. The information is used to make parcels. There are times when the data included in a document could be incorrect or out-of-date.

The precision of the areas in a map depends on both the map and the source of information. Every county has their specific requirements for accuracy of maps. A reliable, well-established digital mapping software will typically provide more precise parcels than hand-drawn maps.

The parcel data includes both the assessed valuation and easements and titles which may be associated with it. This is the most sought-after information from counties. The ease of having everything all in one place boosts the efficiency of both residents and enterprises.

In reality the county parcel information is an important tool for economic development. Information about a parcel can be used to plan and assess tax or even to respond to an emergency.

Tax Maps for Sullivan County

The Sullivan County Tax Map has an unique format for PDF that is accessible in your preferred browser. A printed version is also available from the Sullivan County Real Property Services Office. The file size will dictate how long it takes to download it.

As a guideline, as a guideline, the Sullivan County Tax Map is highly recommended. It includes waterways and roads aswell forest preserves, state parks and game lands. For a more comprehensive map of your property, consult the tax parcel books of your county. If you are looking for more maps, an upgrade service is available.

The Sullivan County Tax Map does not have a formal title. However, you can submit your request to the County Real Property Tax Service and the Sullivan County Clerk. The Clerk is responsible for the registration of deeds, managing an application to look over tax maps, as well as other duties.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. The county has six lakes, as well as agricultural land. Food processing is also in the county. The county’s central area is the place where Chautauqua Lake can be found, which eventually empties into Gulf of Mexico.

The Eastern Continental Divide runs through the region. It empties into Conewango Creek. The lake provides drinking water to the villages around, despite the fact it is situated less than 25 miles away from the nearest open water source.

There are 15 communities within Chautauqua County. Mayville is the capital of the county. The towns in these small cities are very hard-working and have a small population. There are numerous shared services, which have led to an increase in efficiency.

Chautauqua County created the county-wide share services plan for the county-wide share services. It gave preference to low hanging fruit projects. These initiatives have a significant impact on local government. The first year of implementation, the strategy is expected to save the county nearly 1 million dollars.

The county-wide shared service program has established the shared services panel for each county. It is the duty of the panel with the executive on the development and implementation of an local share service strategy.