Chilton County Property Tax Maps – If you’re a property or business owner, it is essential that you use a county’s tax map. Knowing how to properly use parcel mapping, which is a vital element of a tax map, can help you make timely tax payments and preserve the value of your property.

Map of the cadastral tracts

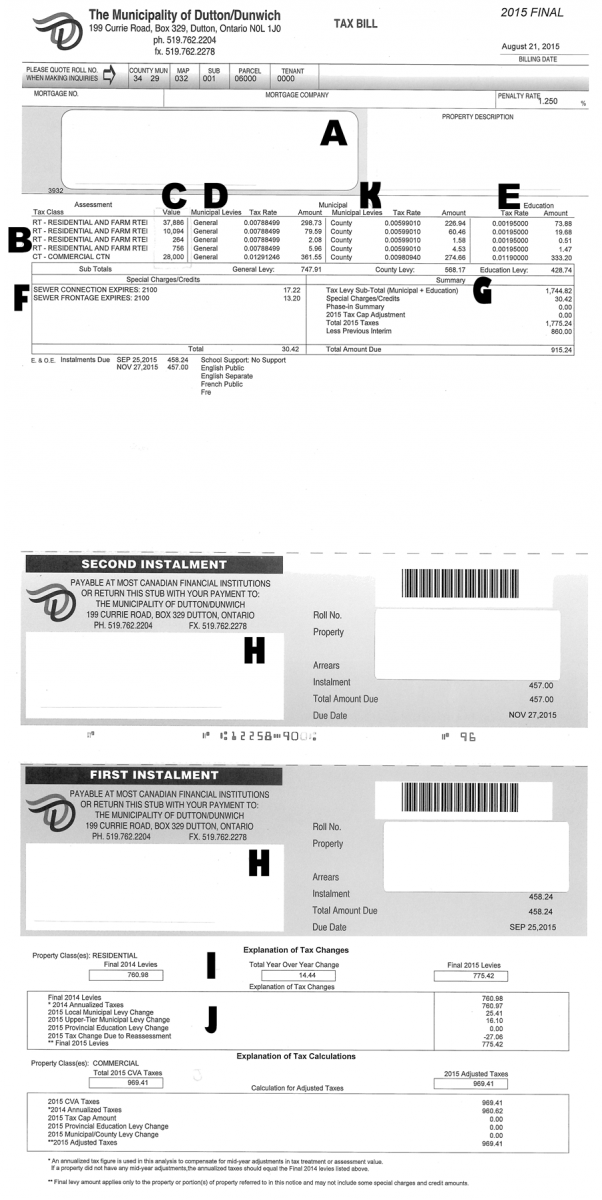

Cadastral parcel mapping is crucial for the evaluation and management of real estate. It aids the assessor to locate each parcel and provide it with a Parcel Identification number.

This is done by taking the parcel’s shape, dimensions, and position. The map shows the connection between the parcels and other parcels can be identified. The plots may be taxed or exempt from taxation.

During the tax mapping procedure the entire territory that will be taxed has been identified. Each tax-exempt piece of real estate must be listed on the tax map. The map must be updated often.

The modification of the tax map is required to change the physical dimensions of the parcel. If the number of parcels is changing, a revision may be required.

Tax maps provide the exact location as well as the amount of each property that is taxed within a county. Each county has tax maps to each assessor in the local area. They aid the assessor to prepare the assessment roll.

accuracy of the county parcels

The exactness of parcels that are shown on county tax maps is influenced by a range of factors. The data’s source is first. To create parcels, you can utilize deeds, subdivision plans along with survey results. Sometimes, the information in a parcel could be inaccurate or out of date.

The accuracy of the parcels of a map depends on the map as well as the information source. Due to this, counties could have different specifications for map accuracy. Instead of the hand-drawn map that can still be found in certain counties but isn’t always accessible, a well-established digital mapping app will usually display more accurate parcels.

The assessed valuation of the property in addition to any connected easements and titles, are all included in the parcel’s data. This is the information that most counties need most. It’s easy to find all the information you need that improves the efficiency of both residents and businesses.

It is possible to utilize county parcel data to aid in economic development. The information about a parcel can be used to plan taxes, planning, and even emergency response.

Tax Maps for Sullivan County

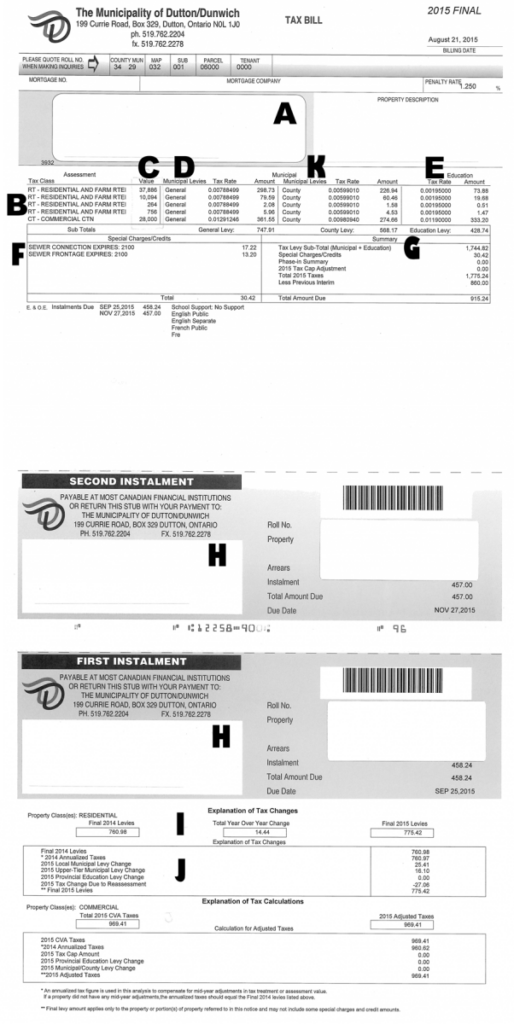

The Sullivan County Tax Map is an enormous PDF file that can be opened in any browser. For those who would like to print a copy in a physical format, a printout is available in the Sullivan County Real Property Services Office. The time required to download a file will be contingent on the size of the file.

It is possible to use the Sullivan County Tax Map to help you. It contains waterways, highways and forests as well as state parks. A more precise plan of your property can be found in your county tax parcel. The premium service is designed for those who desire many maps.

Even though the Sullivan County Tax Map doesn’t have a formal title, you can send any questions to the Sullivan County Clerk and the County Real Property Tax Service. The clerk, among other tasks, is accountable for registering deeds.

Tax Maps for Chautauqua County

Access to the west of New York State is provided through Chautauqua County. There are six lakes and farmland. The food processing sector is also situated. Chautauqua Lake, which eventually spills into the Gulf of Mexico, is situated in the middle of the county.

The Eastern Continental Divide runs through the region. It drains into Conewango Creek. Even though there’s only one location within the county that is over 25 miles from open water, the lake provides an important supply of drinking water to the communities around it.

Chautauqua County has fifteen communities. Mayville is the county seat. These small towns are hardworking and are comparatively small. Shared services have been actively requested, and their efficiency has increased.

Chautauqua County enacted the county-wide shared service plan, which gave priority to projects with low hanging fruit. These initiatives have a significant impact on the municipalities. The first year of implementation the plan is expected to save the county over 1 million dollars.

Each county now has an shared services panel, thanks to the shared services program that is countywide. It is the job of the panel to work with the executive when establishing and implementing a local strategy for shared services.