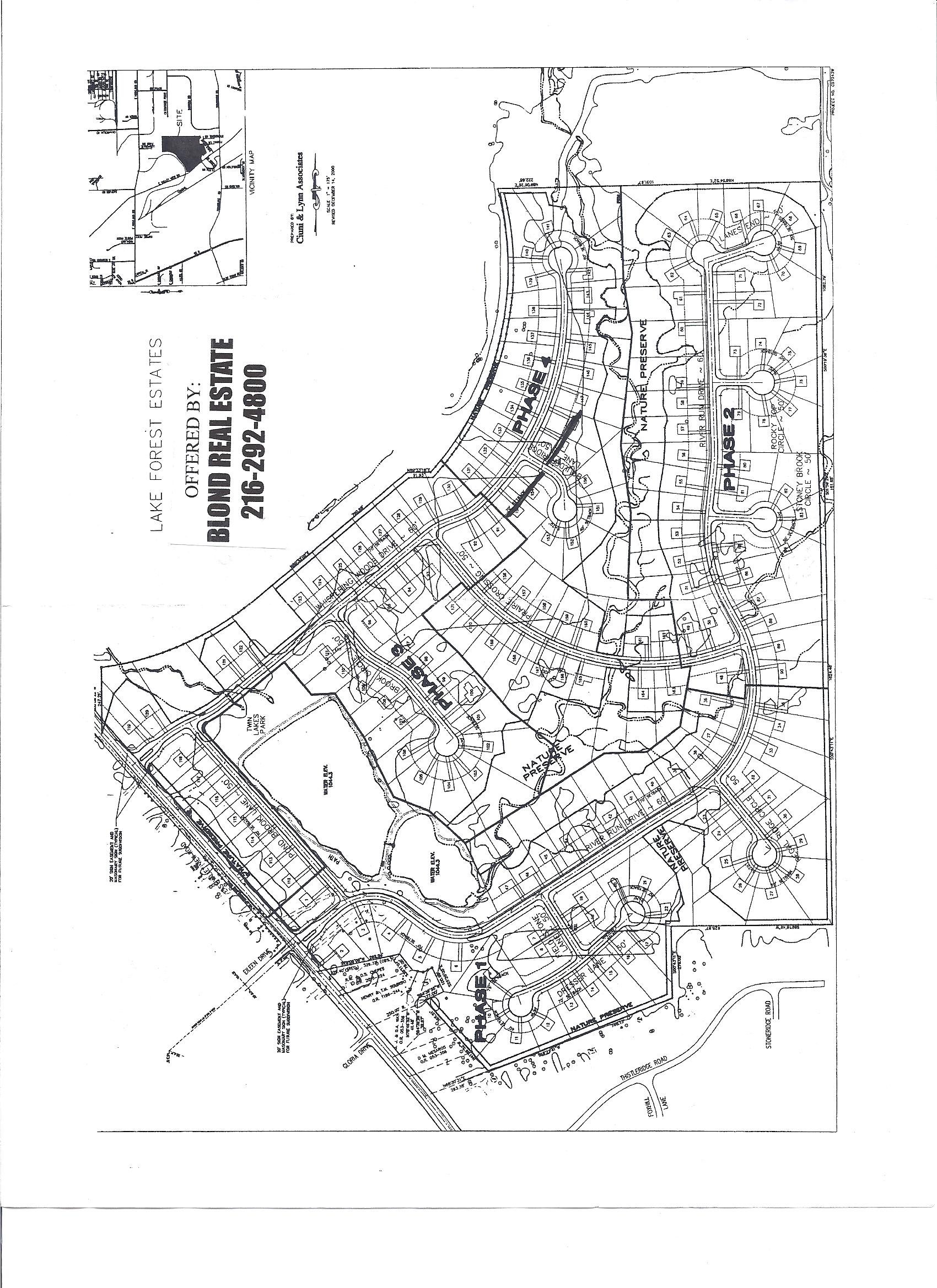

Kane County Tax Maps – If you own property or are the owner of a business, it is important to know the importance and use the tax map for your county. It is important to comprehend how parcel mapping functions on a tax map of the county. This will allow you to make timely tax payments, while preserving your property’s value.

Map of cadastral tracts

Cadastral parcel mapping is crucial to the evaluation of real estate. It aids the assessor to locate each parcel, and assigning it an Identification Number.

This is accomplished by figuring out the parcel’s dimensions, form, and placement. The link between the parcel and other parcels is then depicted in the map. These plots can be taxed or exempt from taxation.

The tax mapping procedure establishes the whole region to be taxed. Each piece of property must be identified on the taxmap. It is important to ensure that the map is updated.

A parcel’s physical dimensions or shape must be changed that is why it is necessary to alter the tax map. When the parcel’s number is altered, modifications are necessary.

The amount and location of every tax-paying property in a county are shown on a tax map. Every county gives tax maps to the local assessor. They are designed to help the assessor in putting together the assessment roll.

accuracy of the county parcels

The exactness of parcels depicted on tax maps for counties is affected by a variety of variables. First, the data’s initial source. To create parcels, you need to make use of deeds and subdivision plans, as well as survey results. There are times when the data contained in a document could be incorrect or out-of-date.

The accuracy or accuracy of parcels appearing on a map is contingent on the content as well as the source of the information. Each county could have its own requirements regarding map accuracy. In contrast to maps drawn by hand, which are still accessible in some counties, modern mapping applications will often show more accurate parcels.

The assessed value of the property, along with any related easements and titles, are all included in the parcel’s data. This is the data most sought by counties. It’s simple to get all the data you require that improves the efficiency of both residents as well as companies.

In reality county parcel data can be an important tool for economic development. You can use the information of a parcel for planning taxes, planning, emergency response, and many other reasons.

Tax Map for Sullivan County

It’s a PDF file which opens in the browser of your choice. The Sullivan County Tax Map can be quite a large. For those who would like to print a copy in a physical format, a printout is available at the Sullivan County Real Property Services Office. The size of the file determines how long it takes to load.

As a guide as a reference, you can use the Sullivan County Tax Map. The map includes roads and waterways as well as forests, state parks and game lands. A more precise plan of your property is included within your county tax parcel. For those who are in search of more maps you can avail a premium service.

The Sullivan County Tax Map does not have a formal name. But, you are able to submit your requests to both the County Real Property Tax Service as well as the Sullivan County Clerk. This office is responsible for, among other things to register deeds.

Tax Maps for Chautauqua County

Chautauqua County offers westward access from New York State. There are six farms, six lakes and the food processing area. Chautauqua Lake, which eventually drains into the Gulf of Mexico, is situated in the middle of the county.

The Eastern Continental Divide runs through the region. It empties into Conewango Creek. The lake supplies drinking water to surrounding villages, even though it is located just 25 miles away from the closest open source of water.

There are 15 communities within Chautauqua County. Mayville is the county capital. Small towns like Mayville are tough, even although they’re not huge. There is a growth in efficiency and the demand for shared services.

The county-wide shared service plan, which gave low hanging fruit projects the top priority and was adopted by Chautauqua County. These initiatives have huge impacts on local governments. This plan could save the county over $1 million within the first year.

Through the county-wide sharing service initiative, every county now has its individual shared services panel. The panel is accountable for working with the executive to develop and implement a local shared services strategy.