Butler County Tax Maps – If you own property , or are the proprietor of a company It is crucial to know the significance and the use of the tax map of the county. Knowing how to use a parcel map, one of the most important elements of the tax map of the county, will ensure that you to pay your taxes on time and maintain the value.

Map of tracts of cadastral land

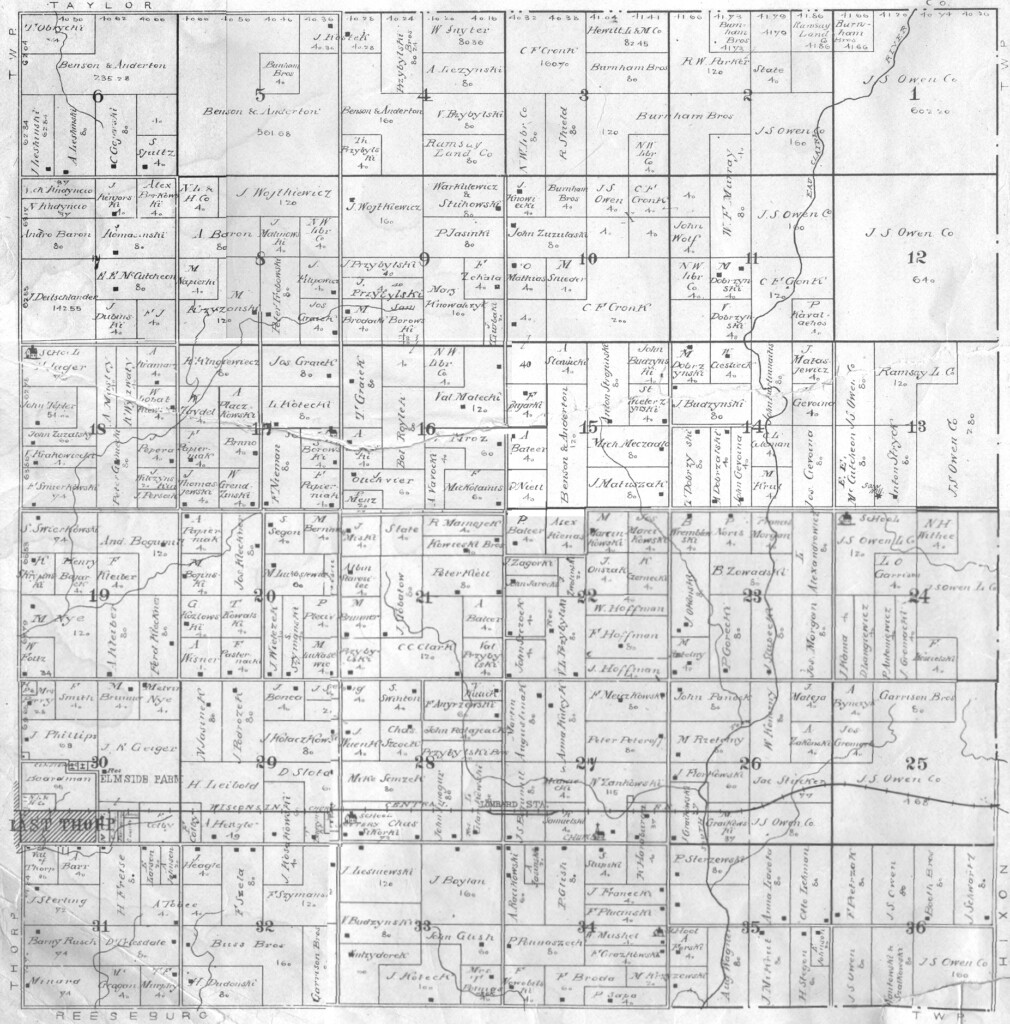

Cadastral parcel mapping is vital in the assessment of real estate. It aids the assessor to locate every parcel and then issue it with the Parcel Identification number.

This is accomplished by figuring out the dimensions of the parcel, its shape, and placement. This map shows the connection between the parcels. These plots could be exempt or taxed.

The entire area that will be taxed will be determined during the tax mapping process. In the tax map, every piece of taxable property must be listed. The map needs to be regularly updated.

A parcel’s physical dimensions or form must be updated, which necessitates modifying the tax map. If the number of parcels is changing, revisions might be required.

The value and location of every tax-paying property in the county are listed on a tax map. Each county gives tax maps to each assessor in the local area. These maps are intended to aid the assessor with the creation of the assessment roll.

the accuracy of the county parcels

Many variables affect the accuracy of county tax maps. The first one is the origin of the information. The information is used to make parcels. The information in a package could be inaccurate or outdated.

The accuracy of parcels on an image is determined by the map and its information source. Each county may have their own requirements regarding map accuracy. Contrary to hand-drawn maps, which are still available in some counties, digital mapping software typically shows more accurate parcels.

The parcel data contains the assessed value for each property, as well as any attached easements and title. This is the most requested information by counties. All information is in one place which makes it simple for residents and businesses to access. This boosts efficiency.

The data on county parcels can be used as an economic development tool. The information on the parcel is useful for planning, tax assessment as well as emergency response.

Tax Maps for Sullivan County

It is a PDF file that opens in the browser of your choice. The Sullivan County Tax Map can be quite large. For those who would prefer to print a copy it is possible to print one obtained at the Sullivan County Real Property Services Office. The size of the file will affect the time taken to download it.

Use the Sullivan County Tax Map as an aid. It is a map of roads as well as forests, rivers as well as game land. There is the most precise maps of your property in the book of tax parcels for the county. If you are looking for more maps, there is an option to purchase a premium service.

The Sullivan County Tax Map has no formal title. It is possible to ask for the map’s information from the Sullivan County Clerk or the County Real Property Tax Service. The clerk, in addition to various other duties, is responsible for the registration of deeds and overseeing a tax map review programme.

Tax Maps of Chautauqua County

Chautauqua County offers westward access from New York State. There are six farms, six lakes and the food processing area. The county’s central area is the place where Chautauqua Lake can be found, which eventually empties into Gulf of Mexico.

The region is bordered by the Eastern Continental Divide. It empties into Conewango Creek. The lake is a major water source for the communities that surround it, even though it is the only one which isn’t open to the public.

There are 15 communities within Chautauqua County. Mayville is the county capital. These towns are small however, they’re hard-working. Demand for shared services has increased and efficiency has increased.

The county-wide shared service plan, which gave low hanging fruit projects the highest priority, was enacted by Chautauqua County. The initiatives have a significant impact on municipalities. The plan anticipates saving the county around 1 million dollars within the first year following its implementation.

Every county has a county-wide panel for shared services thanks to the county’s shared services initiative. The panel’s responsibility is to collaborate with the executive on developing and carrying out an local shared services plan.