Wasco County Tax Lot Map – A tax map for the county is vital for property owners and company owners. The main component of tax map of a county, the parcel map, is crucial for timely tax payment. It will also help in maintaining the property’s value.

cartography of cadastral parcels

Cadastral parcel mapping is vital for the assessment of real estate. It allows the assessors to pinpoint each parcel and then issue the parcel with an Identification Number.

This is accomplished by determining the parcel’s dimensions and form, its location, and other details. The map will show the connections between each parcel and the other parcels. The plots may be exempt from tax or even exempt.

In the process of tax mapping the tax map is a way to determine which region will be subject to tax. Each piece of property must be identified on the taxmap. The map should be regularly kept up to date.

It is essential to alter the tax map in order to change the physical dimensions or forms of parcels. If the shape or number of parcels changes the parcel’s shape, it’s also required to make revisions.

A tax map displays the value and the location of every tax-exempt property within a county. Every county gives tax maps to the local assessor. These maps help the assessor with making the assessment roll.

Accuracy of county parcels

Numerous variables can impact the accuracy displayed on tax maps of counties. First, the original source. Deeds and subdivision plans and survey results may all be used to create parcels. The information contained on a parcel may thus be incomplete or outdated.

The accuracy or lack of accuracy of a particular parcel on a map is contingent on the content and the information source. Each county may have their specific requirements for accuracy of maps. Contrary to hand-drawn maps, that are still in use in some counties, modern mapping software typically shows more accurate parcels.

The parcel data includes the assessed value for each property, as well as any easements or titles attached to it. This is among the most sought-after information from counties. All the information is available in one location which makes it simple for both businesses and residents to access. This boosts efficiency.

In reality, county parcel data is an effective tool for economic development. Information about a parcel can also be used to determine the best way to use it and assess tax or even to respond to an emergency.

Tax Maps for Sullivan County

The Sullivan County Tax Map, that is a PDF document that opens in any browser that you prefer it’s a beast. If you’d prefer a printed copy you can visit the Sullivan County Real Property Services Office. The size of the file will determine how long it takes to load.

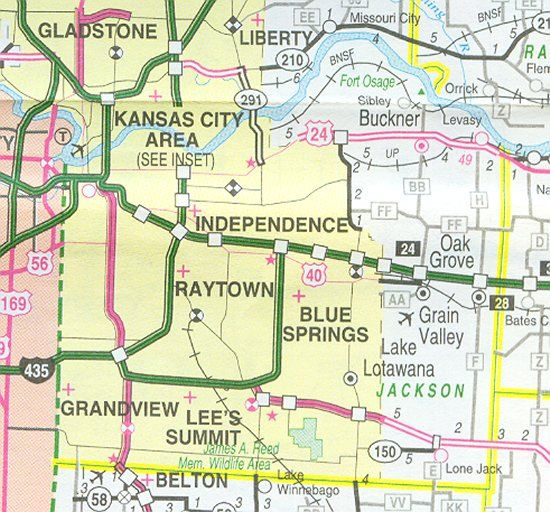

As a guide as a reference, you can use the Sullivan County Tax Map. Along with waterways and highways It also includes state parks, forests and game land. To get a more accurate plan of your land, check the tax parcel book of your county. Premium service is available to those who want several maps.

The Sullivan County Tax Map does not have a formal title. You can make the necessary requests to both the County Real Property Tax Service and the Sullivan County Clerk. The Clerk, in addition to other tasks, is accountable for registering deeds.

Tax Maps of Chautauqua County

Chautauqua County provides westward access to New York State. There are six lakes in the county, agricultural land, and the processing facility for food. The county’s middle is Chautauqua Lake which eventually flows into the Gulf of Mexico.

The Eastern Continental Divide passes through this region. It flows into Conewango Creek. The lake provides drinking water to the villages that surround it, despite the fact that it is located less than 25 miles away from the closest open source of water.

Chautauqua County has fifteen communities. Mayville is the county’s capital. Small towns like Mayville are tough, even however they’re not big. Services that are shared have been highly requested, and their efficiency has grown.

Chautauqua County created the county-wide share services plan. It gave priority to projects that are low-hanging fruit. The initiatives have a significant impact on municipalities. The strategy anticipates saving the county more than one million dollars in the first year following its implementation.

The county-wide shared service program has established an array of shared services for each county. The panel is responsible for working with the executive to create and establish a local shared service strategy.