Clarke County Tax Map – You must be aware of the significance of using a tax map for your county whether you’re an owner of a business or property owner. You can make timely tax payments and protect the value of your home by learning how to use parcel mapping.

cartography of cadastral parcels

Cadastral parcel mapping is critical in the assessment and management of real estate. It assists the assessor in locating every parcel and then issue it with an Identification number.

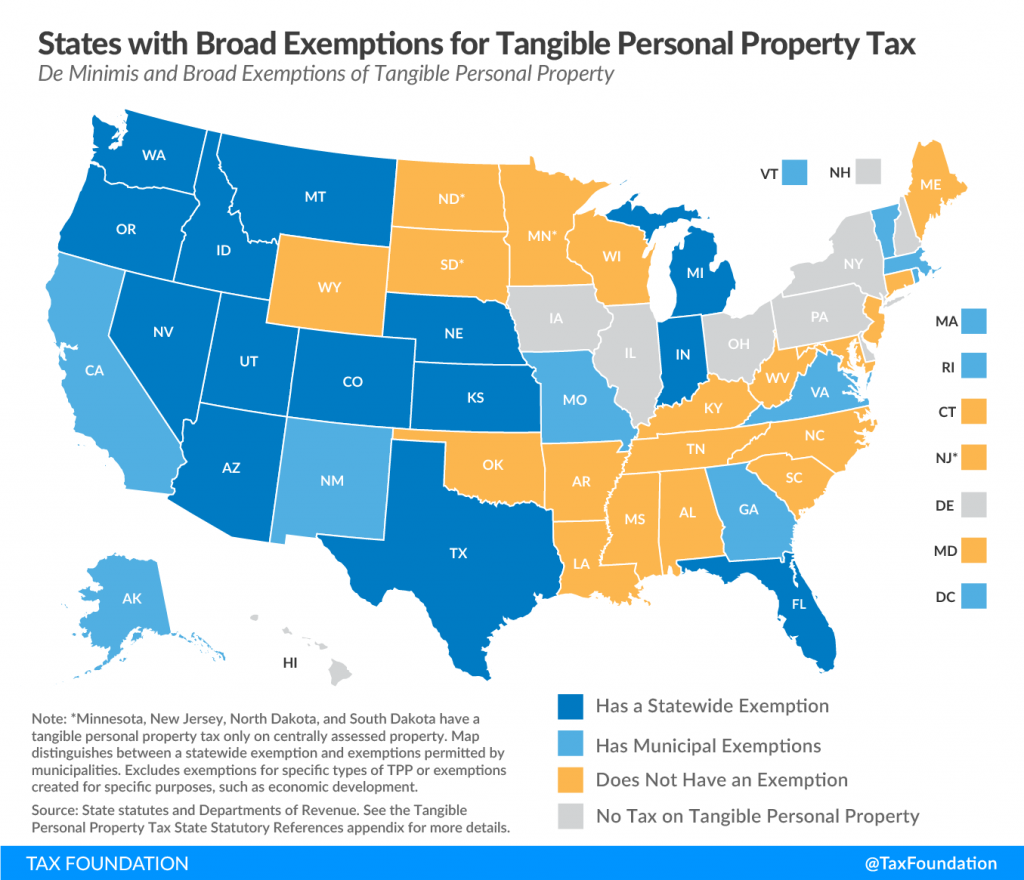

It is a matter of taking note of the parcel’s size, shape, and location. The map shows the connection between the parcels as well as other parcels can be displayed. The plots could be taxed or exempt from taxation.

When it comes to tax mapping the entire area that will be taxed has been identified. Each piece of taxable real estate should be noted on the tax map. The map must be regularly updated.

Modifying the tax map is needed to change the physical dimensions of the parcel. If the shape or number of parcels changes the parcel’s shape, it’s also required to amend the tax map.

Tax maps show the value and location of each taxable property located within a county. Every local assessor is provided tax maps from the county. They are designed to assist the assessor in putting together the roll of assessment.

Precision of county parcels

Many variables could impact the accuracy displayed on tax maps for counties. first, the information’s original source. To create parcels, you need to utilize deeds, subdivision plans, as well as survey results. The information on a package could be inaccurate or outdated.

The accuracy or accuracy of parcels appearing on a map is determined by its content and the information source. Because of this, counties may have various specifications for accuracy of maps. A digital mapping application which is reliable and established will show you more precise parcels, unlike hand-drawn ones that may be available in some counties.

The parcel data includes the assessed value of the property along with any associated easements and titles. This is the information that most counties require the most. It’s easy to find all the data you require, which improves productivity for both residents as well as companies.

Actually, the county parcel data can be used to aid in economic development. A parcel’s information could be used for planning taxes, planning, and even for emergency response.

Tax Map for Sullivan County

The Sullivan County Tax Map is a huge PDF file that can be viewed using any browser. For those who prefer printing copies it is possible to print one obtained at the Sullivan County Real Property Services Office. The amount of time needed to download a file is contingent on the size of the file.

For a reference for a guide, refer to the Sullivan County Tax Map. Along with highways and waterways, it also contains forests, state parks and game areas. To obtain a more accurate plan of your land, check the tax parcel book for your county. An upgraded service is offered for those with an appetite for a variety of maps.

Even though the Sullivan County Tax Map lacks a formal name You can make the necessary requests to the Sullivan County Clerk’s office and the County Real Property Tax Service. This office is responsible in addition to other duties to register deeds.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. The county has six lakes in the county, farmland as well as the food processing industry. Chautauqua Lake, which eventually empties into the Gulf of Mexico, is situated in the middle of the county.

The Eastern Continental Divide passes through this region. It empties into Conewango Creek. The lake is a major source of water for the villages around it, even though it is the only place which isn’t open to the public.

There are 15 communities within Chautauqua County. Mayville is the county seat. These towns are small, but they are hardworking. These towns are a hub of sharing services, and their efficiency has increased.

Chautauqua County adopted the county-wide sharing service plan for sharing services across the county. It gave priority to projects with low hanging fruit. These initiatives have a profound impact on local government. In the first year the plan is expected to help the county save over $1 million.

Every county has a county-wide panel for shared services as a result of the county’s shared service initiative. The panel has the responsibility to work closely with the executive in establishing and implementing a local sharing services strategy.