Arlington County Property Tax Map – If you own a property or are the proprietor of a company, it is important to understand the significance of and utilize a tax map for your county. Learning how to utilize a parcel map, an essential element of the tax map of a county, will help you pay your taxes on time and keep the value.

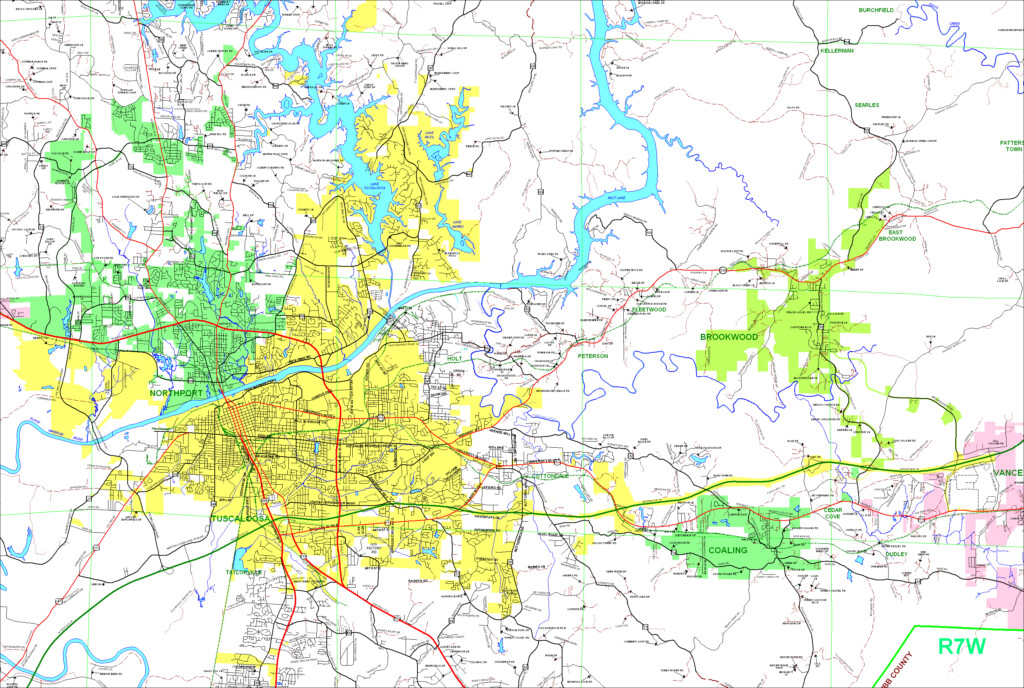

Cartografting the cadastral parcels

The assessment of real estate can be made much easier with cadastral parcel mapping. It assists the assessor to locate each parcel and issuing it with an Identification Number.

This involves determining the dimensions, shape, and location. This map shows the relationship between the parcels. These plots can be tax-free or exempt.

Tax mapping is the process by which the tax map in its entirety is drawn. Every property subject to taxation must be listed on the tax map. The map should be frequently up-to-date.

The tax map must also be updated to reflect changes to the physical dimensions and the shape of a parcel. When the number of parcels is altered, modifications are required.

Tax maps show the location and amount of all tax-exempt properties in the county. The county provides tax maps to each local assessor. These maps are intended to aid the assessor in creating the roll of assessment.

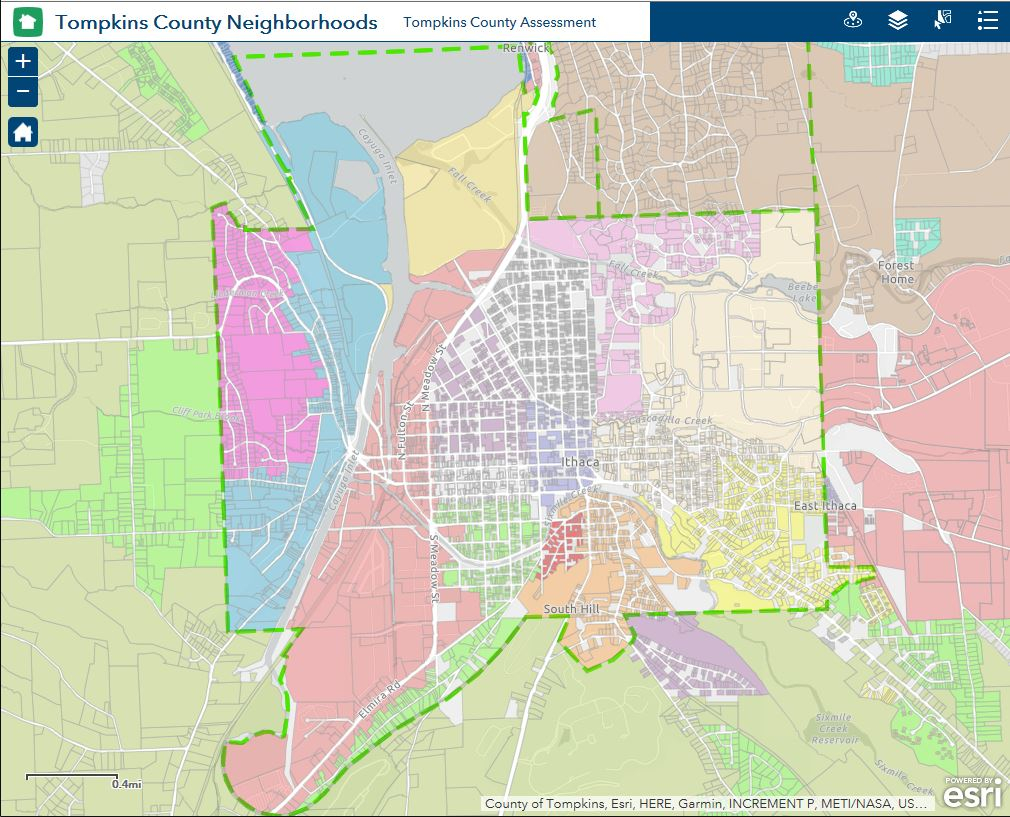

Accuracy of parcels in the county

Many variables could affect the accuracy of county tax maps. The first is the source of the information. There is a way to make parcels using survey data and subdivision plans, deeds, and even deeds. A package’s information may not be accurate or current.

The quality and accuracy of the parcels shown on a map depend on the source information as well as the map. Different standards may be applicable to the accuracy of maps for different counties. An established, reliable digital mapping application will usually show more precise parcels than hand-drawn maps.

The parcel data includes both the assessed valuation as well as easements and titles that could be linked. This is the most sought-after information by counties. It is easy to find everything you need in one place which improves the efficiency of businesses and residents.

There is a way to make use of the county parcel information to aid in economic development. Data about a parcel could be used to plan and assess tax or even to respond to an emergency.

Tax Map for Sullivan County

It is a PDF file which opens in your browser. The Sullivan County Tax Map can be quite a monster. The printed version is available from the Sullivan County Real Property Services Office. The amount of time needed to load a file will be contingent on its size.

To help you as a reference, you can use the Sullivan County Tax Map. It includes waterways and roads aswell as state parks, forests and game lands. A more precise plan of your property is available in your tax parcel for the county. Premium service available to those who want several maps.

Even though the Sullivan County Tax Map lacks the formal title, you can submit the necessary requests to the Sullivan County Clerk’s office and the County Real Property Tax Service. The clerk is accountable for the recording of deeds and managing an application to look over tax maps, as well as other functions.

Tax Maps for Chautauqua County

Chautauqua County allows westward entry into New York State. The county has six lakes, agricultural land, as well as the food processing industry. The county’s central area is where Chautauqua Lake can be found that eventually drains into the Gulf of Mexico.

The Eastern Continental Divide cuts through the region. It drains into Conewango Creek. Even though there is only one location within the county that is more than 25 miles away from open water, Conewango Lake is a an important supply of drinking water to the communities surrounding it.

Chautauqua County contains fifteen communities. Mayville is the capital of the county. These towns are small but resilient. There’s been an increase in efficiency as well as demand for services shared.

Chautauqua County created the county-wide share services plan. It prioritized low hanging fruit projects. These initiatives have a profound impact on local government. In its first year the plan will reduce the cost of the county by $1 million.

Every county now has a county-wide panel of shared services as a result of the county’s shared services initiative. The panel’s responsibility is to work in conjunction with the executive on developing and carrying out an local shared services plan.