Bosque County Tax Map – It is important to be aware of the importance of using a county tax map if you are an owner of a business or property owner. You can make timely tax payments and maintain the worth of your home by learning how to utilize parcel mapping.

cartography of cadastral parcels

Cadastral parcel mapping is critical for the evaluation and management of real estate. It assists the assessor in locating every parcel and issuing it with an Identification Number.

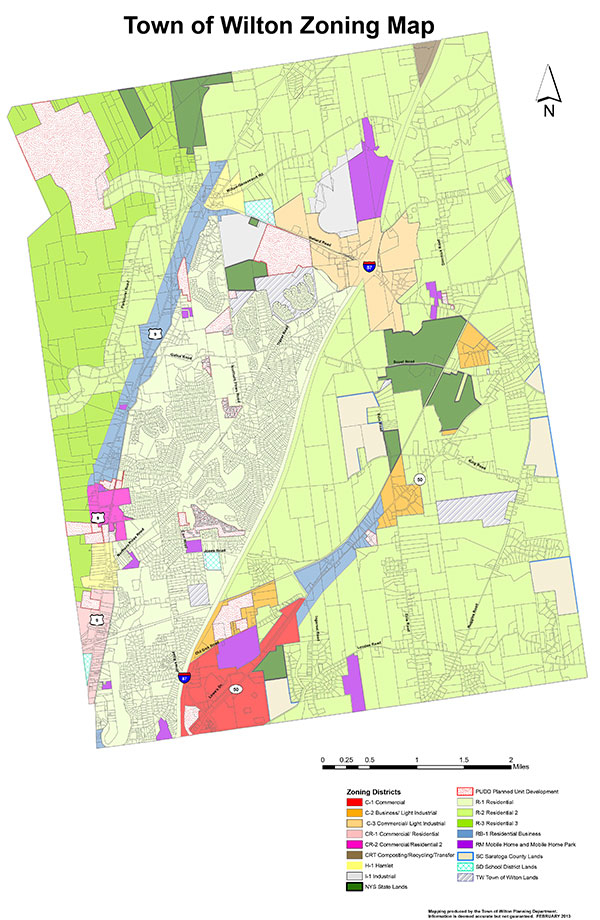

It is a matter of finding out the parcel’s size, shape, and location. The map shows how the parcels connect. The plots could be taxed or exempt from taxation.

When tax mapping is conducted, the entire tax map is created. Every piece must be listed on the taxmap. The map should be updated often.

The physical dimensions of a parcel or the form of the parcel must be revised that is why it is necessary to alter the tax map. If the shape or number of parcels changes, it is also necessary to make revisions.

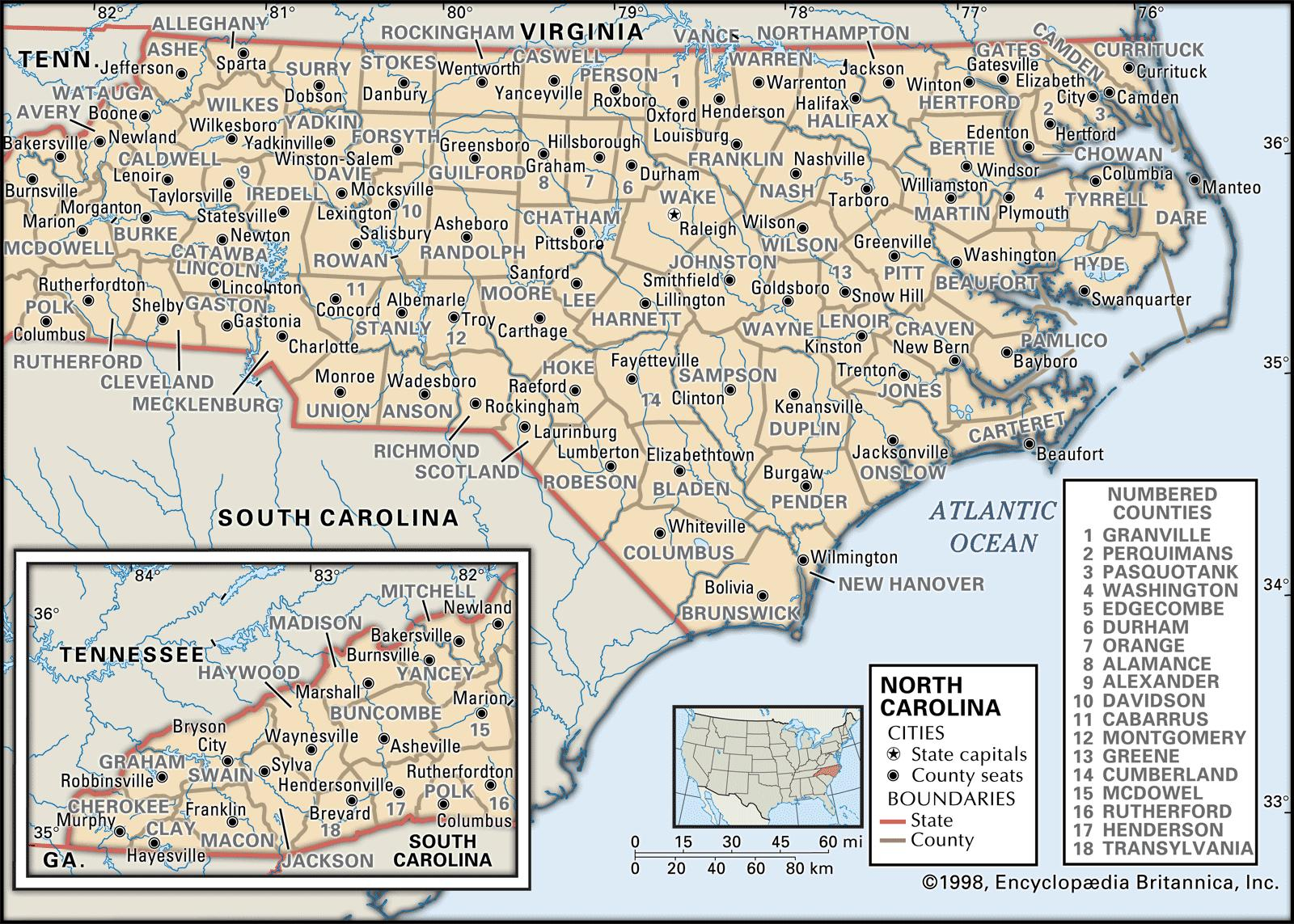

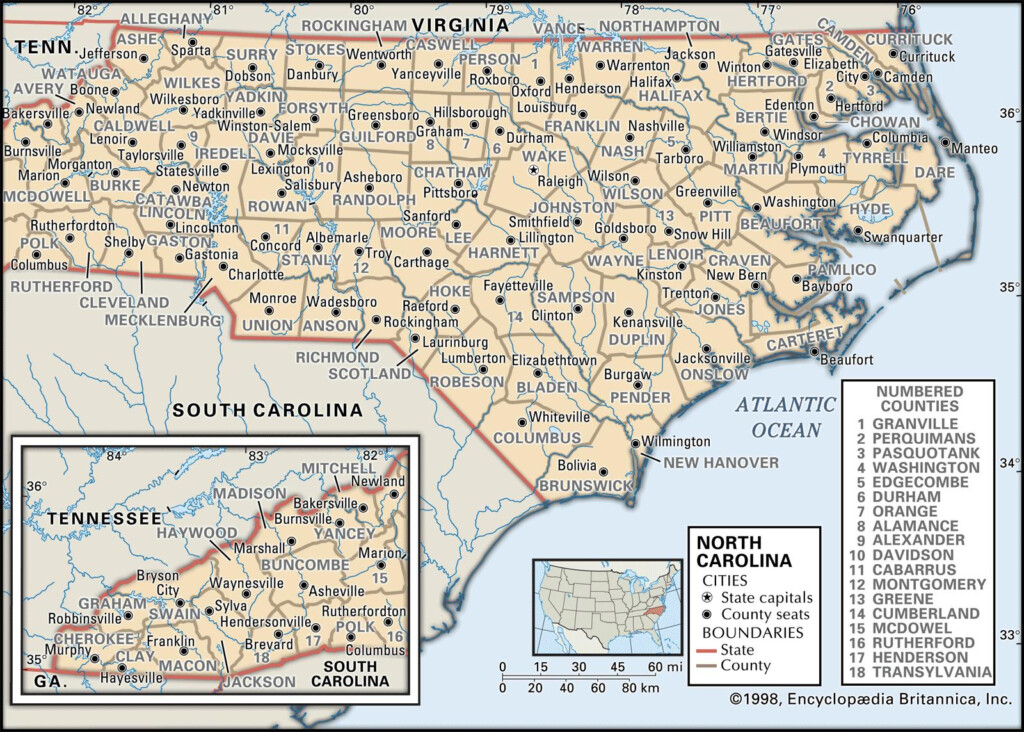

Tax maps show where and how much each property is situated in a given county. The county gives tax maps to every local assessor. These maps are meant to assist the assessor in the creation of the roll of assessment.

Accuracy of county parcels

The accuracy of the parcels depicted on tax maps of the county is influenced by a number of factors. First, the original source of the data. It is possible to create parcels using survey results or subdivision plans, deeds and even deeds. Sometimes, the information in a document could be outdated or incorrect.

The accuracy of the parcels on a map depends on the map as well as the information source. That’s why some counties have different requirements regarding accuracy of maps. A digital mapping program that is well-established and reliable will provide you with more precise parcels as opposed to hand-drawn ones that are accessible in specific counties.

The parcel information contains the assessed value of each property, as well as any easements and titles that are attached. This is the most important information requested by counties. It’s easy to find all the data you require that increases the productivity of both residents as well as businesses.

The county parcel data can be used as an economic development tool. The information on the property can be used to plan tax assessments, planning as well as emergency response.

Tax Maps for Sullivan County

The Sullivan County Tax Map has the unique format of PDF. It is accessible in your preferred browser. For those who prefer printing copies it is possible to print one obtained at the Sullivan County Real Property Services Office. The size of the file will affect the time it takes it to load.

For a reference, you can refer to the Sullivan County Tax Map. It includes roads, rivers, forests as well as game land. To obtain a more accurate plan of your land, check the tax parcel book of your county. Premium service is for those who desire many maps.

The Sullivan County Tax Map is not officially named, but you can send the required requests to the Sullivan County Clerk’s Office and the County Real Property Tax Service. The Clerk is in charge of registering deeds and managing an audit program for tax maps as well as other responsibilities.

Tax Maps of Chautauqua County

Westward access to New York State is provided via Chautauqua County. There are six farms, six lakes, as well as the food processing sector. Chautauqua Lake, which eventually drains into the Gulf of Mexico, is situated in the middle of the county.

The Eastern Continental Divide passes through this region. It drains into Conewango Creek. The lake provides water to villages in the vicinity and is only 25 miles from open waters.

There are 15 communities in Chautauqua County. Mayville is the county’s seat. The small towns are hard-working and are very small. Demand for services shared has increased and efficiency has increased.

Chautauqua County created the county-wide share services plan for the county-wide share services. It gave priority to projects with low hanging fruit. These initiatives have huge impacts on the municipalities. In its first year the strategy is expected to reduce the cost of the county by $1 million.

With the county-wide sharing services initiative, each county now has their own shared services panel. The panel is accountable to work with the executive to create and implement a local shared service strategy.