Brooke County Tax Map – A tax map for the county is crucial for property owners and company owners. It’s possible to timely pay tax payments and maintain the worth of your property by learning how to utilize parcel mapping.

mapping of cadastral parcels

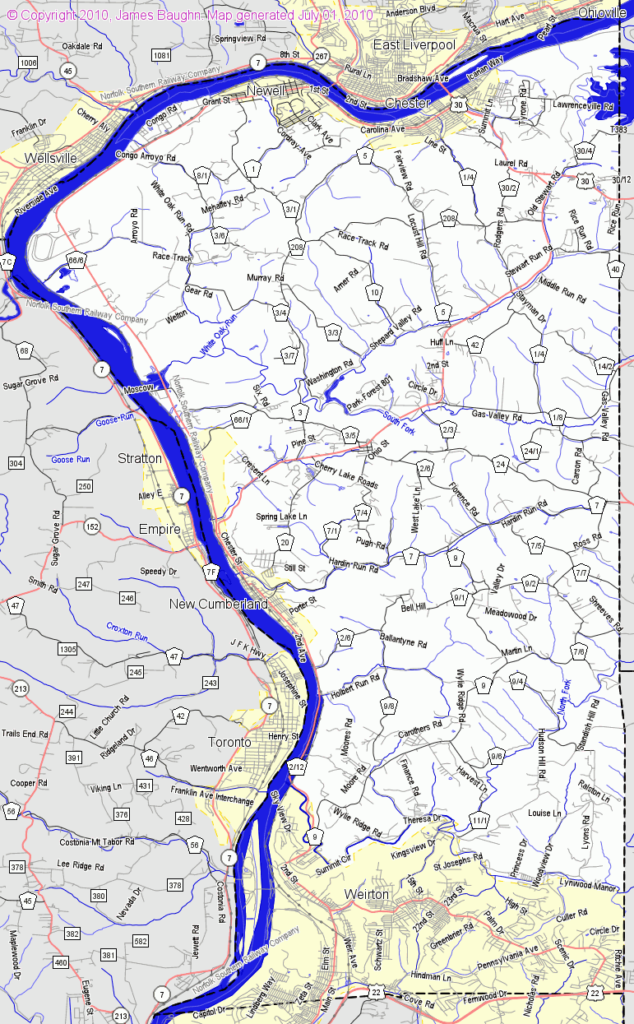

The evaluation of real property is made easier by the cadastral mapping of parcels. It assists the assessor in finding each parcel and issuing it with a Parcelle Identification Number.

This is done by determining the dimensions of the parcel shape, size, location as well as other information. The link between the parcel and other parcels is displayed on the map. The plots may be taxed or exempt.

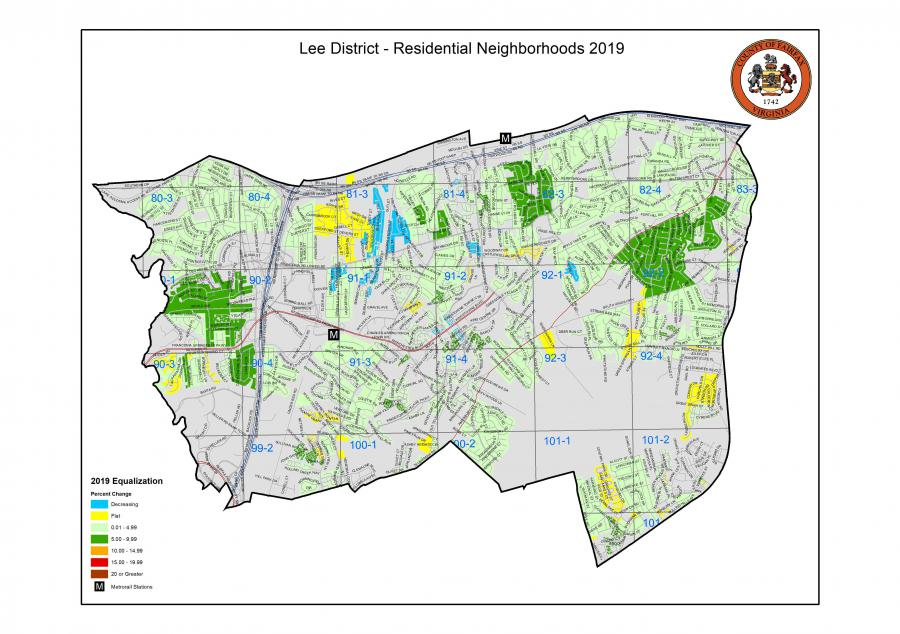

During tax mapping, the entire tax map is constructed. Every piece of taxable property is required to be shown on an tax map. The map should be regularly updated.

The tax map also needs to be updated to reflect changes in physical dimensions and shape of a parcel. If the number of parcels has changed, then revisions may be required.

The value and location of every taxable property in the county are listed on a tax map. The county provides tax maps to every local assessor. These maps assist the assessor in making the assessment roll.

The accuracy of the county parcels

The exactness of parcels shown on county tax maps is influenced by a number of factors. First, the original source. The information is used to make parcels. A parcel’s information might not be current or accurate.

The accuracy of the parcels shown on the map is determined by the map in addition to the source of information. Every county has their own requirements regarding map accuracy. A digital mapping application that is reliable and well-established will provide you with more precise parcels in contrast to hand-drawn maps that are available in some counties.

The parcel data includes both the assessed value and easements and titles that may be connected. It is the most common information requested by counties. All information is accessible in one place, making it easy for businesses and residents to find. This boosts efficiency.

The county parcel’s data could be an important tools for economic development. It is possible to use the data of a property for planning, tax assessment, emergencies, and for other uses.

Tax Maps for Sullivan County

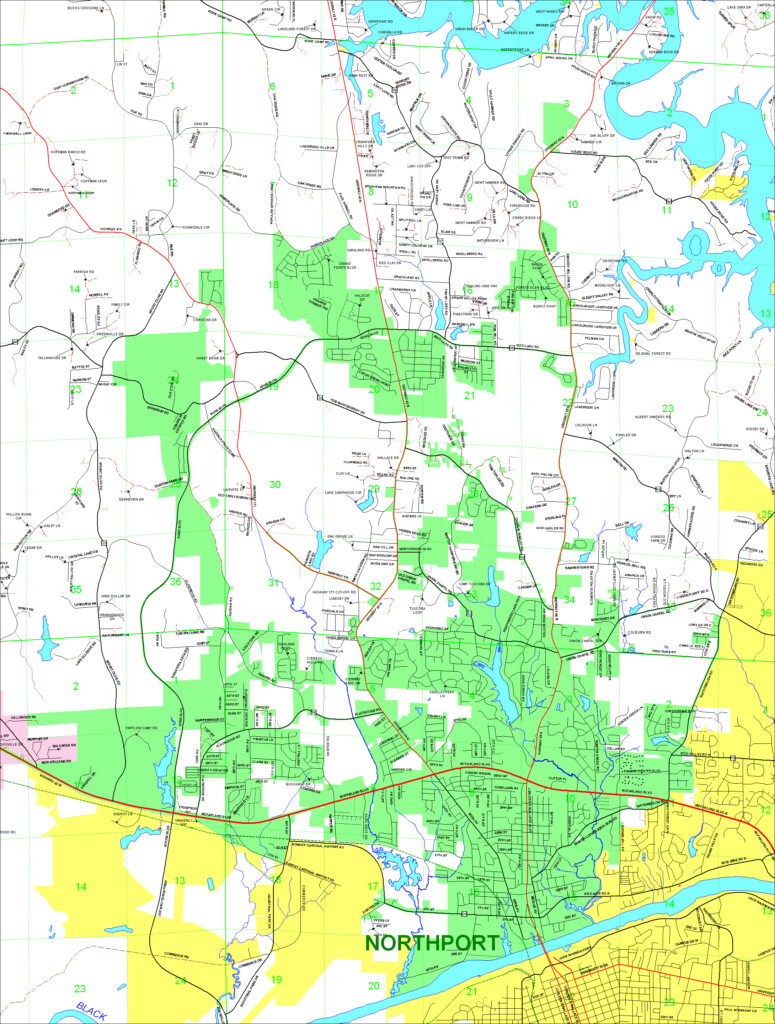

It’s a PDF file that can be opened within your browser. The Sullivan County Tax Map can be quite large. If you’d prefer a printed copy you can visit the Sullivan County Real Property Services Office. The size of the file will affect the amount of time required to load it.

Make use of the Sullivan County Tax Map as an aid. The map includes waterways and roads aswell forest preserves, state parks and game land. For a more detailed plan of your home, check your county tax parcel books. For those who are looking for more maps, an upgrade service is available.

The Sullivan County Tax Map does not have a formal name. However, you can make the necessary request to the County Real Property Tax Service as well as the Sullivan County Clerk. The clerk is responsible for the registration of deeds, managing an application to look over tax maps and perform other duties.

Tax Maps for Chautauqua County

Access to the west of New York State is provided via Chautauqua County. There are six lakes, as well as agricultural land. The food processing sector is also in the county. The county’s center is located where Chautauqua Lake flows into the Gulf of Mexico.

The Eastern Continental Divide traverses the region. It drains into Conewango Creek. Although the lake is less than 25 miles from the open water in the county, it is significant drinking water for the villages nearby.

The number of communities in Chautauqua County is fifteen. Mayville is the county seat. These towns are tiny but they’re incredibly hardworking. There’s been an increase in efficiency and demand for services shared.

The county-wide shared service plan, which gave low-hanging fruit projects the highest priority and was adopted by Chautauqua County. These initiatives have significant impacts on municipalities. The county could be able to save over $1million during its first year of operation.

Through the county-wide shared services program, every county now has a shared panel of service. The panel is accountable to work together with the executive in the creation and establish a local shared service strategy.