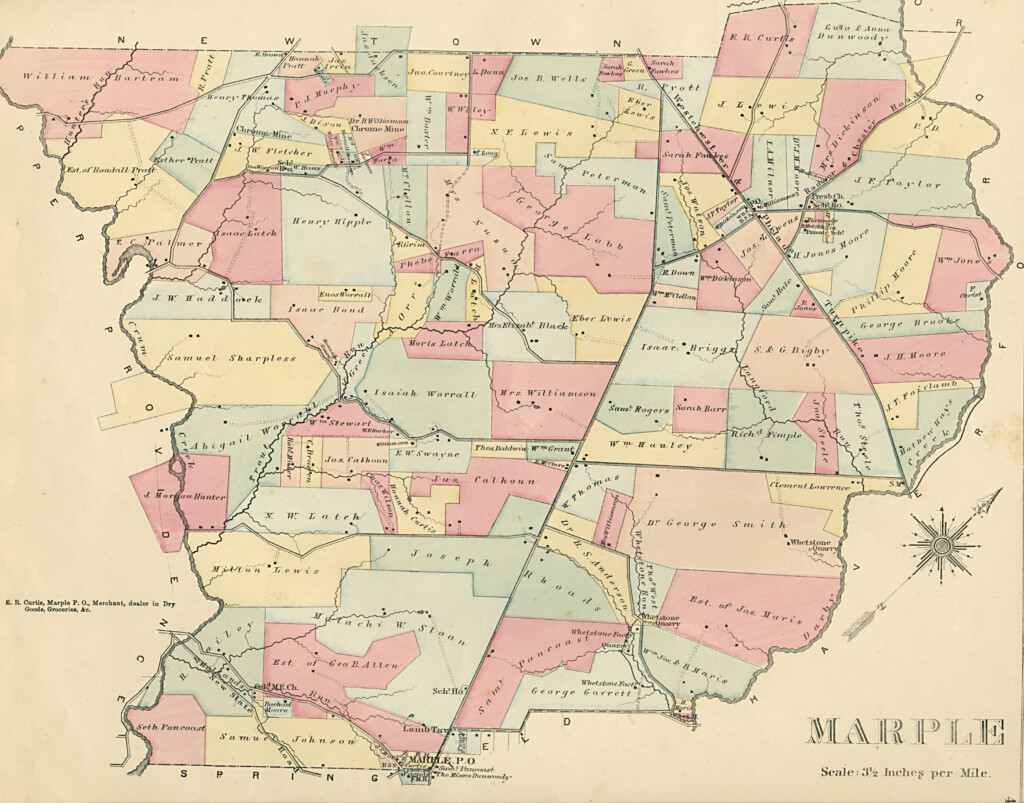

Broome County Tax Map 1961 – A county tax map is essential for property owners and company owners. Knowing how to properly use parcel mapping, which is a vital element of a tax map, will assist to make timely tax payments and maintain the worth of your property.

The mapping of parcels of cadastral land

The assessment of real estate is made simpler by the cadastral map of parcels. It aids the assessor in finding each parcel and assigning it a Parcel Identification Number.

This is achieved by determining the dimensions, shape and location. The map illustrates the connections between the parcels. These plots can be taxed or exempt.

When tax mapping is conducted, the entire tax map is drawn. Each tax-exempt piece of real estate must be listed on the tax map. The map needs to be regularly updated.

Revisions are necessary when a parcel’s form or physical dimensions must be changed. This requires modification of the tax map. Furthermore, changes in the shape and size of parcels will require revisions.

A tax map shows the value and the location of every tax-exempt property within a particular county. Each local assessor gets with tax maps from the county. They are designed to help the assessor in creating the roll of assessment.

Precision of the county parcels

There are a variety of factors that affect the exactness of parcels shown on tax maps of counties. first, the information’s original source. There is a way to create parcels using survey results, subdivision plans, deeds, and even deeds. A parcel’s information might not be current or accurate.

The accuracy or accuracy of parcels appearing on a map is contingent on the content as well as the source of the information. Different rules may apply to map accuracy for different counties. Instead of the hand-drawn map that is still in use in certain counties but isn’t always readily available, a well-established digital mapping software will generally provide more precise parcels.

The parcel information includes the assessed valuation of the property as well as any easements or titles that are associated with it. This is the data most sought by counties. It’s easy to find all the information you need that improves the efficiency of both residents and companies.

It is possible to utilize county parcel data for economic development. The information from a parcel could be used for tax assessment, planning, or emergencies.

Tax Maps for Sullivan County

It is a PDF file that opens in the browser you prefer It is true that the Sullivan County Tax Map is quite a monster. If you would prefer a printed copy go to the Sullivan County Real Property Services Office. The time required to load a file is contingent on the size of the file.

As a guideline, as a guideline, the Sullivan County Tax Map is recommended. The map contains waterways and roads as well as forests, state parks and game lands. A more precise map of the property can be found within your county tax parcel. Premium service available to those who want several maps.

The Sullivan County Tax Map has no formal title. It is possible to ask for the map’s information from the Sullivan County Clerk or the County Real Property Tax Service. The clerk is also responsible, among other things for the registration of deeds.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. The county has six lakes, as well as agricultural land. The food processing industry is also situated. The county’s central part is the place where Chautauqua Lake can be found, which eventually empties into Gulf of Mexico.

The Eastern Continental Divide cuts through the region. It drains into Conewango Creek. Although there is only one location within the county that is over 25 miles from open water, the lake supplies substantial drinking water for the villages around it.

The number of communities that reside in Chautauqua County is fifteen. Mayville is the capital of the county. The towns are small, but hardworking. There’s been an increase in efficiency as well as demand for services shared.

Chautauqua County created the county-wide share services plan for the county-wide share services. It prioritized projects that are low-hanging fruit. The initiatives will have a major impact on the municipalities. The first year of implementation the strategy is expected to help the county save $1 million.

Thanks to the county-wide sharing service initiative, each county now has their own shared services panel. The panel has the obligation to collaborate with the executive on creating and developing a local sharing service strategy.