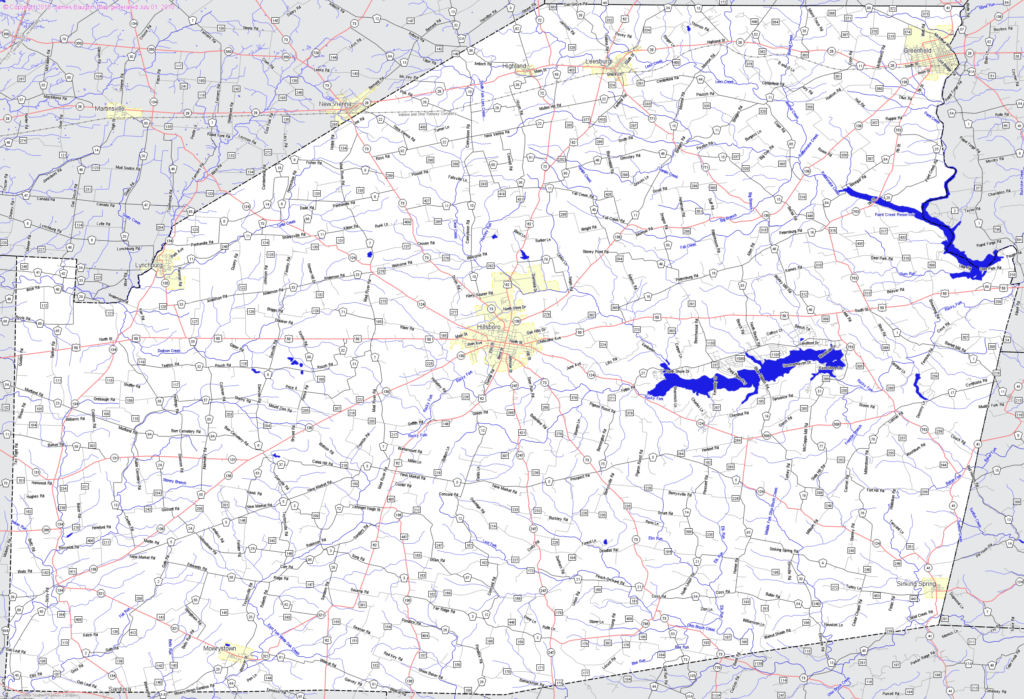

Brown County Ohio Tax Map – If you’re a property proprietor, or a company owner or a business owner, you must be aware of how important it is to use the county map for tax purposes. The main component of tax map for a county is parcel mapping, is essential to ensure timely tax payments. It can also assist in maintaining the property’s value.

Cartografing the cadastral parcels

Cadastral parcel mapping plays a vital function in the evaluation of real estate. It permits the assessor to locate each parcel, and then issue the parcel with the Parcle Identification Number.

This is done by determining the dimensions of the parcel, its shape and its location. The map shows the link between the parcels and the other parcels could be displayed. The plots may be taxed or exempt.

When tax mapping is carried out it is decided which region will be subject to tax. Every property subject to taxation should be identified on a tax map. The map should be updated regularly.

The modification of the tax map is necessary to update the parcel’s physical dimensions. Also, revisions are required when the number of parcels change.

Tax maps show the location and value of each property is situated in the particular county. Every local assessor is provided tax maps from the county. The maps aid the assessor with making the assessment roll.

The exactness of county parcels

There are a variety of variables which affect the accuracy and reliability of the tax map parcels of the county. The first is the data’s initial source. It is possible to create parcels using survey results and subdivision plans, deeds, or even deeds. A parcel’s information might not be current or accurate.

The precision of the areas of a map depends on both the map and the source of information. This is the reason why different counties have different requirements regarding accuracy of maps. In lieu of the hand-drawn map that can still be found in some counties , but is not always accessible, a well-established digital mapping application will typically show more accurate parcels.

The entire data which includes the assessed value of the property, as well as any easements or titles that relate to it are part of the data for the parcel. This is the data most requested by counties. It’s easy to find all the data you require that improves the efficiency of both residents as well as companies.

There is a way to make use of the county parcel information to aid in economic development. You can use the information of a parcel to plan taxes, planning, emergency response, and other uses.

Tax Maps for Sullivan County

The Sullivan County Tax Map is an enormous PDF file that can be opened in any browser. A printed version is also available from the Sullivan County Real Property Services Office. The file’s size will determine how long it will take to load.

To help you, you can refer to the Sullivan County Tax Map. It includes highways, waterways and forests as well as state parks. Find an exact map of your property within the tax parcels book for your county. If you are seeking more maps, a premium service is offered.

While the Sullivan County Tax Map doesn’t have an official title, you are able to send any questions to the Sullivan County Clerk and the County Real Property Tax Service. The clerk is accountable for the registration of deeds, overseeing a program to review tax maps, as well as other functions.

Tax Maps for Chautauqua County

Chautauqua County offers westward access from New York State. There are six farms, six lakes and the food processing area. The middle of the county is the home of Chautauqua Lake. It eventually runs into Gulf of Mexico.

The region is traversed by the Eastern Continental Divide. It empties into Conewango Creek. It is a significant source of water for the communities that surround it, even though it is the only location which isn’t open to the public.

There are fifteen communities in Chautauqua County. Mayville is considered the county seat. These towns are small, but they are hardworking. These communities are a hotbed of sharing services, and their efficiency has grown.

Chautauqua County established the countywide shared services plan for shared services across the county. It gave the lowest-hanging fruit the top prioritization. These initiatives have a huge impact on the local governments. The first year of implementation the strategy is expected to help the county save $1 million.

Every county has a county-wide panel for shared services as a result of the county’s shared service initiative. The panel’s responsibility is to work in conjunction with the executive on developing and carrying out a local shared services strategy.