Calhoun County Georgia Tax Map – It is important to be aware of the significance of having a county tax map if you are an owner of property or a company owner. It is essential to know how parcel mapping functions on a tax map for a county. This will allow you to make timely tax payments, while preserving the value of your property.

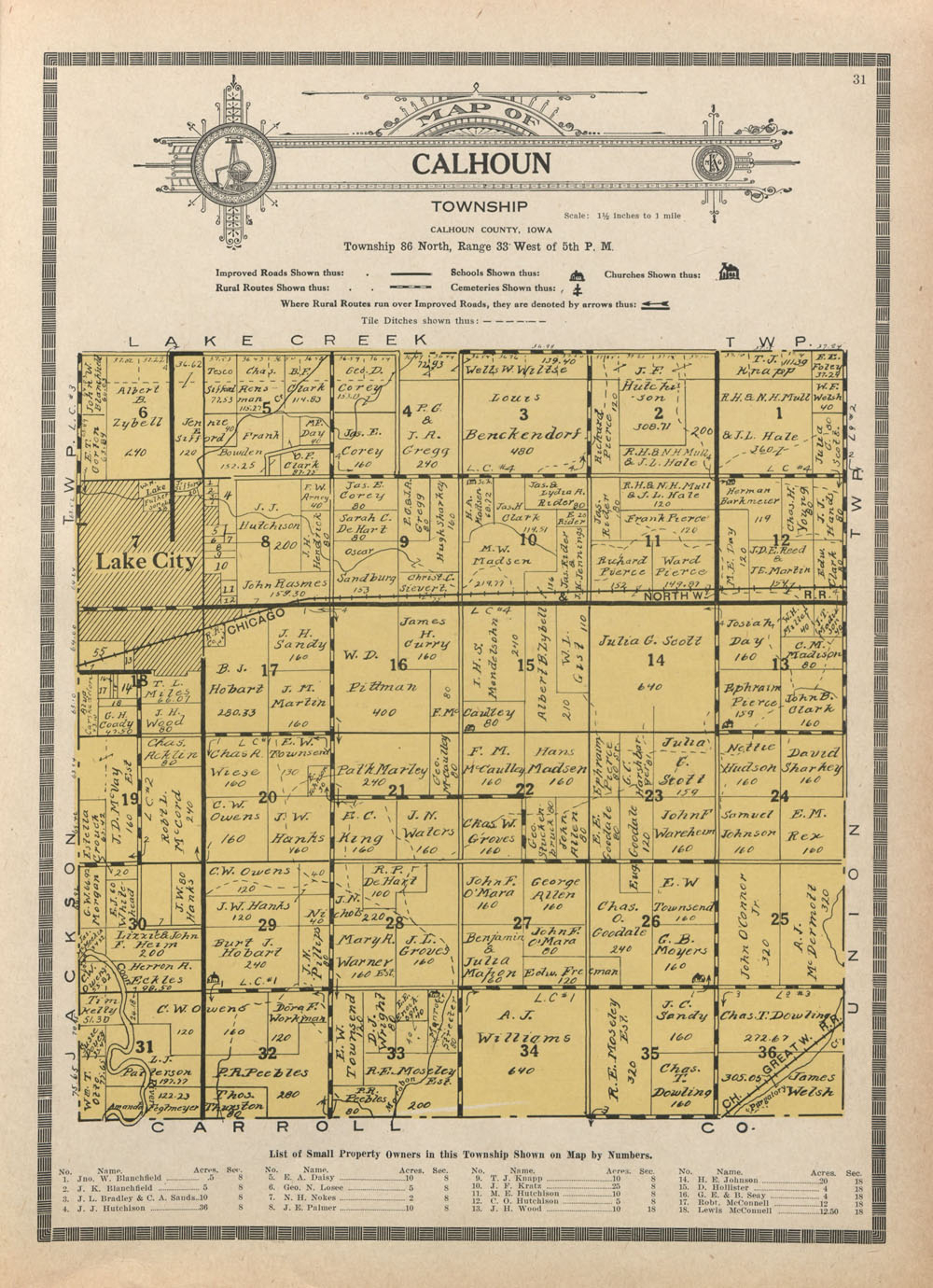

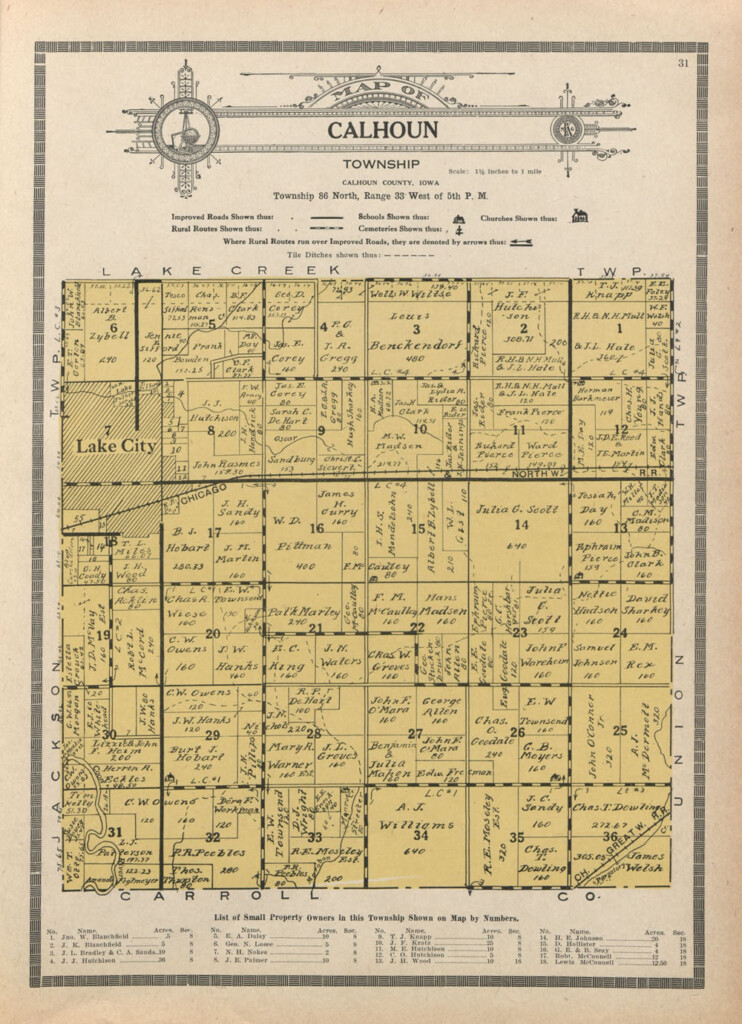

Map of tracts of cadastral land

Cadastral parcel mapping is a crucial role in the evaluation of real-estate. It assists the assessor in locating each parcel and provide it with the Parcel Identification number.

The process involves taking note of the size, shape and its location. The map shows connections between the parcels and other parcels can be identified. The plots can be taxed or exempt.

During the tax mapping process it is decided the part of the area that will be subject to tax. Every piece must be listed on the taxmap. The map must be updated frequently.

A parcel’s physical dimensions or form must be updated and this requires a change to the tax map. Furthermore, changes in the number and shape of parcels will require revisions.

A tax map shows the location and the amount of tax-exempt properties within the county. The county gives tax maps to every local assessor. They are intended to aid the assessor when putting together the assessment roll.

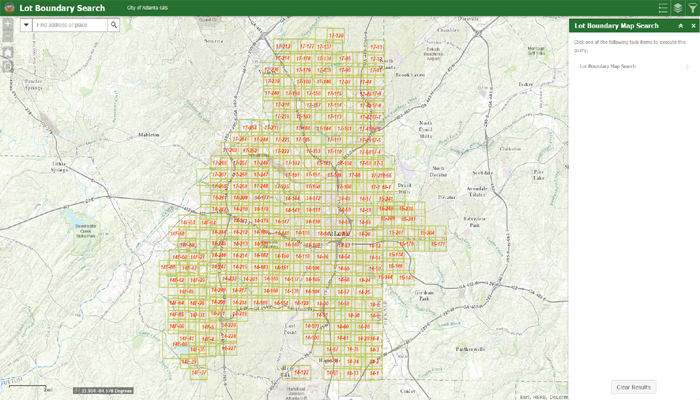

The accuracy of the county parcels

There are a variety of factors that affect the exactness of parcels displayed on tax maps of counties. The source of the information is first. It is possible to use survey results, deeds, and subdivision plans to form parcels. The information in a package may thus be incomplete or outdated.

The accuracy or inaccuracy of parcels on a given map depends on its contents and the source of information. Different requirements may apply to the accuracy of maps for different counties. In contrast to maps drawn by hand which are still available in certain counties, digital mapping software will typically show more precise parcels.

The assessed valuation of the property along with any related easements and titles, are all included in the parcel’s data. This is the information counties frequently request. It is simple to locate everything you need in one place which improves the efficiency of the residents and businesses.

In fact the information from the county parcel can be used to aid in economic development. Data about a parcel could also be used to plan and assess tax or even to respond to an emergency.

Tax Maps for Sullivan County

In that it is an Adobe PDF file that can be opened in the browser of your choice The Sullivan County Tax Map is an absolute beast. If you’d prefer a printed copy, please visit the Sullivan County Real Property Services Office. The amount of time needed to download a file will be contingent on the size of the file.

Utilize the Sullivan County Tax Map as an example. It covers waterways, highways, forests, and state parks. For a more detailed plan of your home, refer to your county tax parcel books. The premium service is for those who want to have a variety of maps.

Even though the Sullivan County Tax Map doesn’t have a formal title, you can still submit any requests to the Sullivan County Clerk and the County Real Property Tax Service. The Clerk is in charge of registering deeds, and overseeing the tax map review program, among other duties.

Tax Maps for Chautauqua County

Chautauqua County offers westward access from New York State. Six farms, six lakes and the food processing area. The county’s center is located where Chautauqua Lake flows into the Gulf of Mexico.

The Eastern Continental Divide runs through the region. It drains into Conewango Creek. It is a significant water source for the villages surrounding it although it is the only location that is not open water.

There are 15 communities within Chautauqua County. Mayville is the county capital. These towns are small , but efficient. There’s been an increase in efficiency and demand for shared services.

Chautauqua County adopted the county-wide sharing services plan for sharing services across the county. This gave priority to projects that are low hanging fruits. The initiatives will have a major impact on local governments. In the first year, the strategy is expected to help the county save nearly $1 million.

Thanks to the county-wide sharing services initiative, every county now has its individual shared services panel. The panel is accountable for working with the executive to create and establish a local shared service strategy.