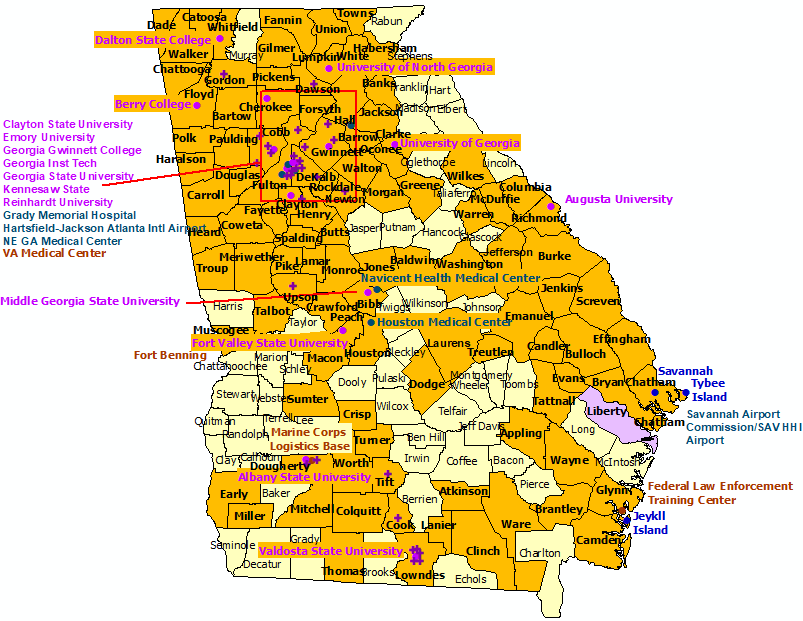

Forsyth County Ga Tax Map – A county tax map is essential for business and private property owners. Learning how to utilize parcel mapping, a crucial element of a county’s tax map, can help you pay your taxes on time and preserve the value of your property.

mapping of parcels of cadastral land

Cadastral parcel mapping is essential to the management and evaluation of real estate. It helps the assessor locate every parcel and then issue it with a Parcel Identification number.

This is accomplished by determining the parcel’s dimensions shape, size, location as well as other information. The map then shows the connection between each parcel and other parcels. The plots can be taxed (or exempt).

The whole region that will be taxed will be determined during the tax mapping procedure. Each piece of property that is taxed should be listed on the tax map. The map must be regularly updated.

It is necessary to modify the tax map in order to alter the physical dimensions or shapes of parcels. It is also required to make revisions when the size of parcels changes.

The location and amount of each tax-exempt property within a county are shown on tax maps. Each local assessor is provided with tax maps from the county. They are intended to aid the assessor in putting together the roll of assessment.

Accuracy of the county parcels

The exactness of parcels that are shown on county tax maps is influenced by a range of factors. First, the original source. It is possible to make parcels using survey data and subdivision plans, deeds and even deeds. The information contained on a parcel could be inaccurate or outdated.

The accuracy of the parcels in a map depends on the map as well as the source of information. This is the reason why different counties have different requirements for map accuracy. In contrast to maps drawn by hand that are still in use in certain counties, digital mapping applications will often show more accurate parcels.

All data which includes the value assessed for the property as well as any related easements or titles are included in the parcel data. This is the data that counties need most. It’s simple to get all the data you require that improves the efficiency of both residents as well as businesses.

The county parcel data can be used as an economic development tool. The information from a parcel could be used to assess tax planning, planning, or even emergencies.

Tax Maps for Sullivan County

It is the form of a PDF file which opens in the browser you prefer The Sullivan County Tax Map is a bit of a beast. It is also printed available from the Sullivan County Real Property Services Office. The file size will dictate how long it takes to load it.

As a guide for a guide, refer to the Sullivan County Tax Map. It contains waterways, highways, forests, and state parks. A more precise plan of your property can be found in your county tax parcel. Premium service is available to those who need multiple maps.

While the Sullivan County Tax Map doesn’t have an official title, you can still submit any requests to the Sullivan County Clerk and the County Real Property Tax Service. The clerk is responsible for the registration of deeds, overseeing an application to look over tax maps and perform other duties.

Tax Maps for Chautauqua County

Chautauqua County offers westward access from New York State. The county has six lakes in the county, farmland, as well as the area for food processing. The county’s central point is where Chautauqua Lake flows into the Gulf of Mexico.

The Eastern Continental Divide cuts through the region. It empties into Conewango Creek. Although the lake is only 25 miles from the main water within the county, it provides substantial drinking water for the villages nearby.

Chautauqua County has fifteen communities. Mayville serves as the county seat. The towns in these small cities are hardworkingeven although they’re not huge. There is a growth in efficiency as well as demand for shared services.

Chautauqua County created the county-wide share services plan for the county-wide share services. It gave priority to projects that are low-hanging fruit. These initiatives have a profound impact on local governments. In the first year the plan will reduce the cost of the county by $1 million.

Each county has a shared services panel thanks to the shared services program that is countywide. The panel has the obligation to collaborate closely with the executive in establishing and the implementation of a local sharing services strategy.