Franklin County Tax Parcel Map – If you’re a homeowner or an owner of a business or a business owner, you must be aware of how crucial it is to use a county map for tax purposes. Understanding how to properly use parcel map, an essential component of the tax map for a county, will help you to pay your taxes on time and maintain the value.

Cartografing the cadastral parcels

Cadastral parcel mapping is crucial in the assessment and management of real estate. It assists the assessor in locating each parcel and issue it with the Parcel Identification number.

This involves finding out the size, shape and position. The map then shows the link between each parcel and the other parcels. The plots could be tax-free or exempt.

During the tax mapping procedure, the whole area that will be taxed been established. Every piece of taxable property should be listed on the tax map. The map should be regularly up-to-date.

The tax map should also be modified to reflect changes in the physical dimensions and the shape of a parcel. If the size or number of parcels changes, it is also necessary to make revisions.

A tax map shows the location and the amount of all tax-exempt properties in a particular county. The county distributes tax maps to each local assessor. They aid in the preparation of the rolls for assessment.

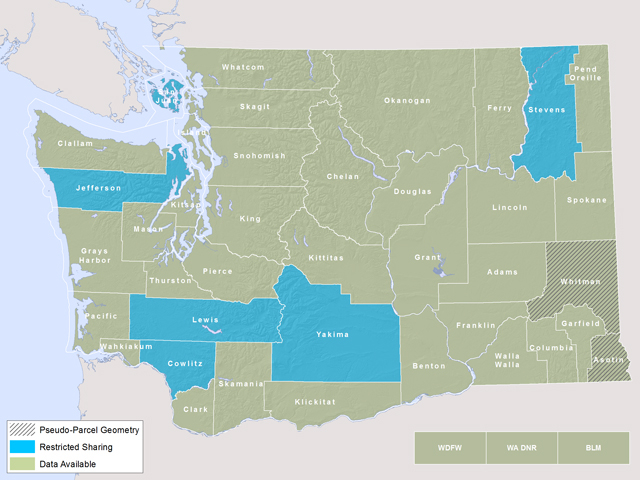

The accuracy of the county parcels

There are a variety of factors that affect the accuracy of tax maps for counties. First, the original source of the data. Every information source can be used to create parcels. It is possible for the information on a document to be inaccurate or out of date.

The accuracy or accuracy of parcels on a given map is determined by its content and the information source. Each county may have their own standards for map accuracy. A solid, established digital mapping software will typically display more precise parcels than hand-drawn maps.

The data for the parcel includes the assessed value and any titles or easements that could be linked. This is the data that counties request most frequently. Everything being in one place makes it easy to access and improves the efficiency of both enterprises and residents.

The data on county parcels can be utilized as an instrument for economic development. Data from a parcel may be used for tax assessment planning, as well as emergency response.

Tax Map for Sullivan County

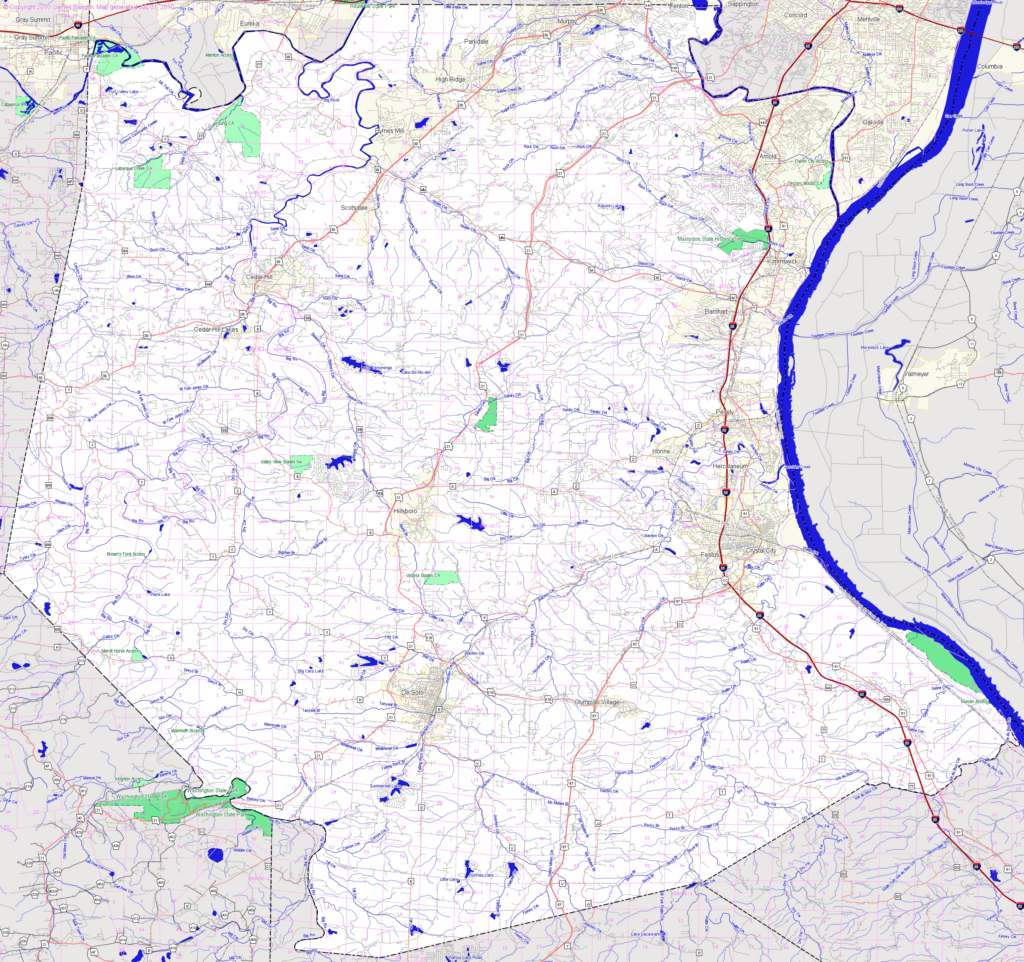

The Sullivan County Tax Map has the unique format of PDF. It can be opened in any browser you prefer. For those who prefer printing copies the map can be purchased from the Sullivan County Real Property Services Office. The amount of time required to download a file will be contingent on its size.

The Sullivan County Tax Map should be used as a guide. It includes roads and waterways as well forest preserves, state parks and game lands. A more precise plan of your property is included in your tax parcel for the county. If you’re looking for more maps, you can avail a premium service.

The Sullivan County Tax Map does not have a formal name. However, you can submit your request to the County Real Property Tax Service as well as the Sullivan County Clerk. The clerk is in charge of registering deeds, and overseeing a tax map review program as well as other responsibilities.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. The county has six lakes in the county, farmland as well as the food processing industry. The county’s middle is Chautauqua Lake which eventually flows into the Gulf of Mexico.

The Eastern Continental Divide cuts through the region. It flows into Conewango Creek. The lake supplies drinking water to surrounding villages, even though it is just 25 miles away from the nearest water source that is open.

Chautauqua County has fifteen communities. Mayville is the capital of the county. These towns are small however, they’re hard-working. Shared services have been actively requested, and their efficiency has grown.

The county-wide shared service plan, which granted low-hanging fruit projects priority to be implemented by Chautauqua County. These initiatives have a huge impact on the municipalities. The plan anticipates saving the county around one million dollars in the first year of operation.

With the county-wide sharing services initiative, each county now has their own shared services panel. It is the responsibility of the panel to collaborate with the executive on developing and carrying out an local shared services plan.