Fulton County Property Tax Map – If you own property or are the proprietor of a company, it is important to be aware of the significance of and utilize a tax map of the county. Learning how to utilize a parcel maps, which are an essential component of the tax map of the county, will ensure that you make your tax payments on time and maintain the value.

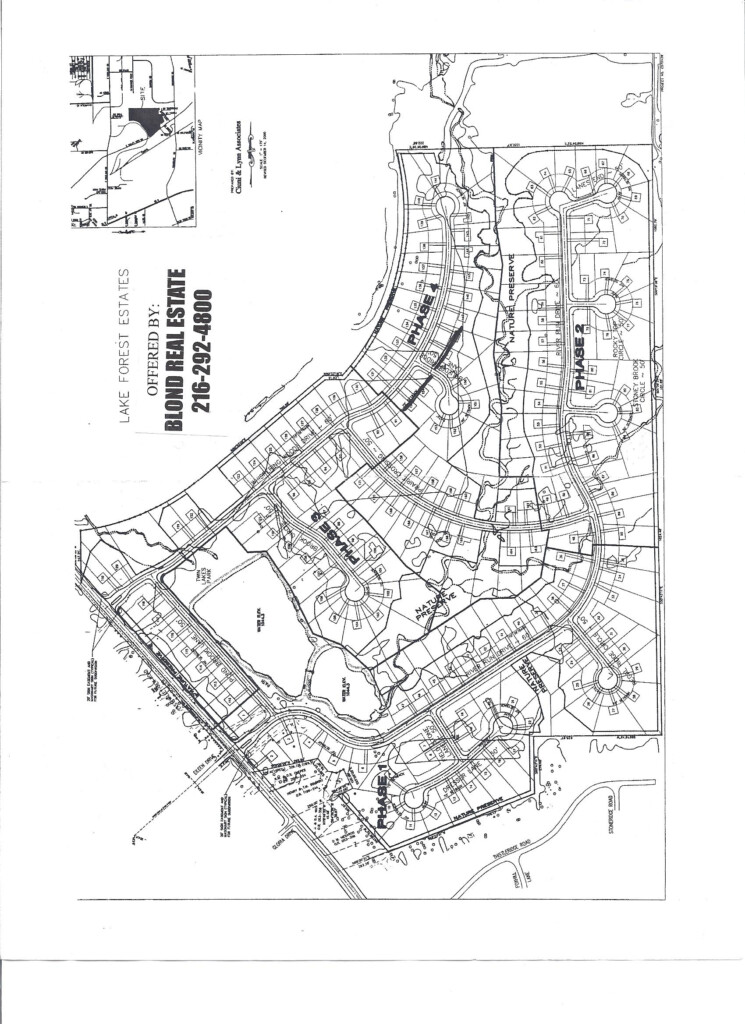

Cartography of the cadastral parcels

It is crucial for the assessment of real estate properties that parcel mapping be carried out in Cadastral. It aids the assessor in locating every parcel and assigning it a Parcel Identification Number.

This is accomplished by figuring out the dimensions of the parcel, its shape, and placement. The map will then show the connection between each parcel and other parcels. The plots may be exempt or taxed.

Tax mapping is the process by which the tax map in its entirety is drawn. Each tax-exempt piece of real estate should be noted on the tax map. The map should be regularly updated.

Revisions are necessary when a parcel’s form or physical dimensions must be altered. This will require a modification to the tax map. If the number or shape of parcels changes then it’s necessary to make revisions.

Tax maps provide the exact location and value for each tax-exempt property within a county. Every county provides tax maps to each assessor in the local area. They assist the assessor in prepare the assessment roll.

Accuracy of parcels in the county

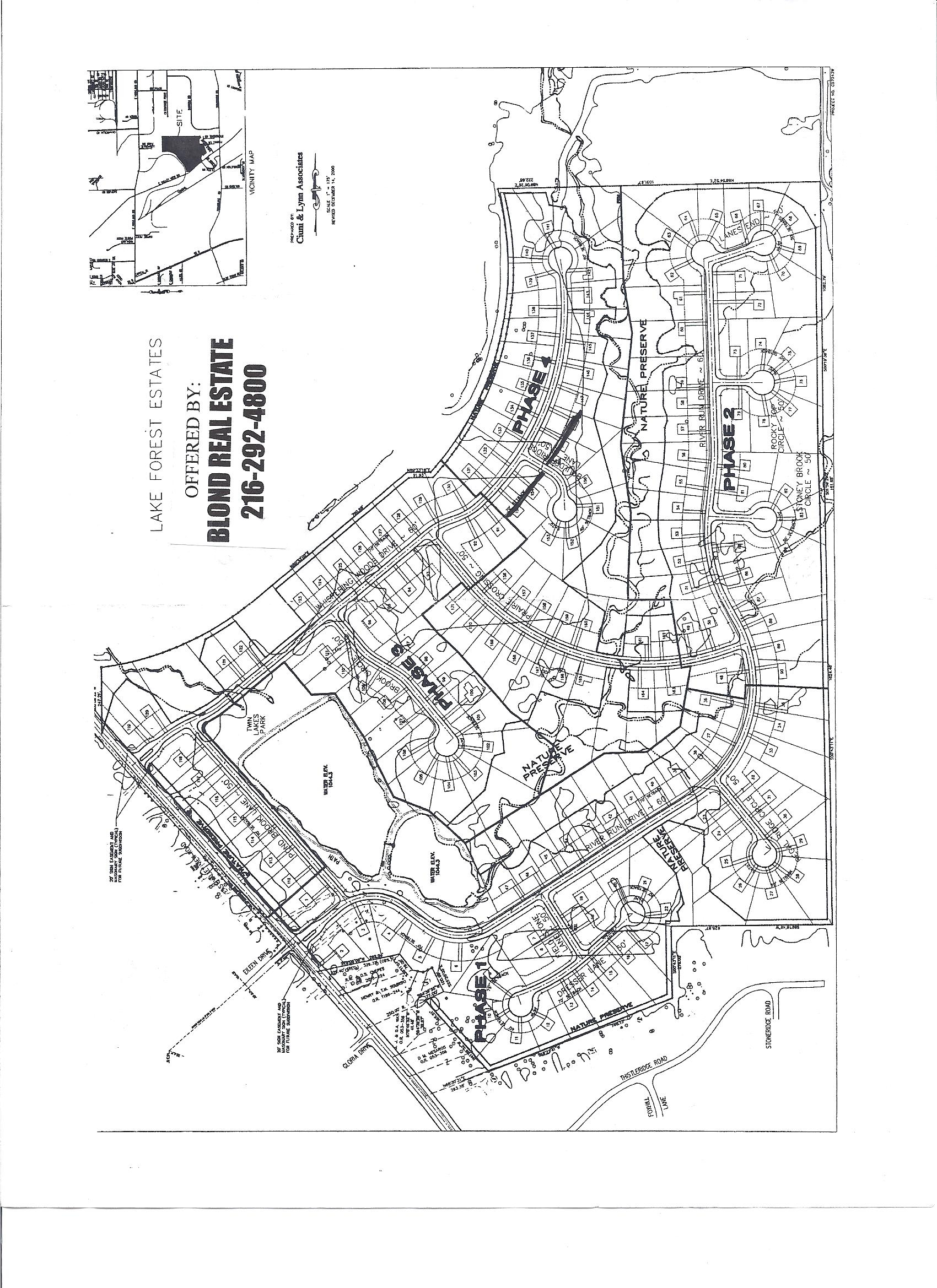

There are many factors that affect the accuracy and reliability of parcels on the tax map of the county. The first one is the origin of the data. You can use survey results, deeds, and subdivision plans to form parcels. This could result in inaccurate or outdated information.

The accuracy of the parcels in the map is determined by the map as well as the information source. This is why counties could have different specifications for map accuracy. As opposed to the hand-drawn maps, which are accessible in some counties, an established, reliable digital mapping application will typically display more precise parcels.

The parcel data includes both the assessed valuation and any titles or easements that could be linked. It is the information that counties frequently request. Everything being in one place makes it easy to access and improves the efficiency of both enterprises and residents.

In reality the county parcel information is an effective tool for economic development. It is possible to use the data of a parcel to plan and tax assessment, as well as emergency response, and other uses.

Tax Maps for Sullivan County

It is a PDF file that can be opened within your browser. The Sullivan County Tax Map can be quite large. The tax map can be printed out by the Sullivan County Real Property Services Office is available to those who want a printed copy. The size of the file determines how long it takes to load.

For a reference for a guide, refer to the Sullivan County Tax Map. It includes roads, rivers, forests as well as game land. You can find an exact map of your property within the county tax parcels book. A premium service is available for those with a thirst for numerous maps.

The Sullivan County Tax Map has no formal name. It is possible to request the map’s information from the Sullivan County Clerk or the County Real Property Tax Service. The clerk, in addition to his tasks, is responsible for the registration of deeds.

Tax Maps for Chautauqua County

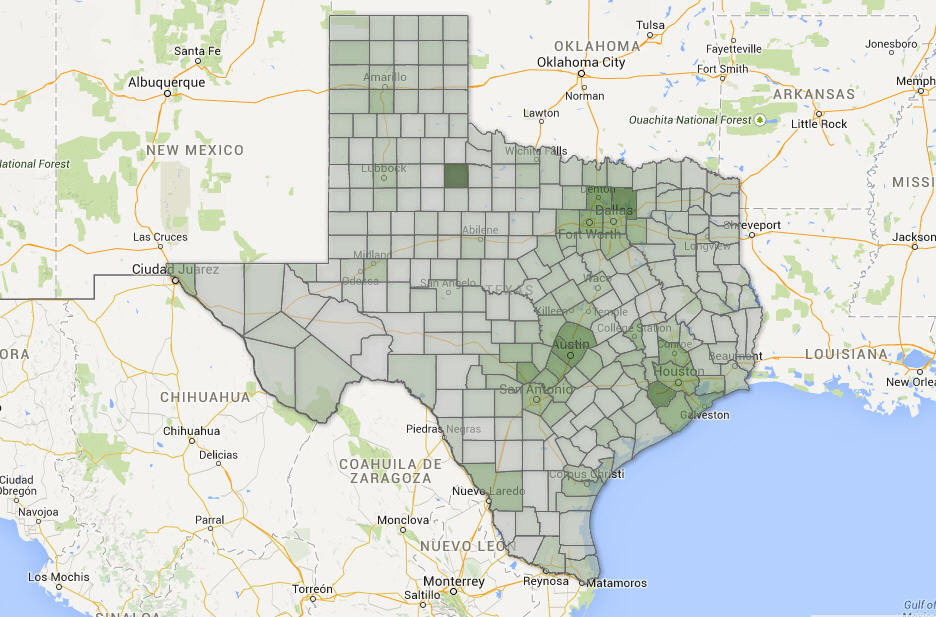

Chautauqua County offers westward access from New York State. There are six lakes as well as farmland. The food processing industry is also situated. The county’s middle is the home of Chautauqua Lake. It eventually runs into Gulf of Mexico.

The region is traversed by the Eastern Continental Divide. It flows into Conewango Creek. The lake supplies drinking water to the surrounding villages, even though it is located less than 25 miles from the closest open source of water.

The number of communities that reside in Chautauqua County is fifteen. Mayville is known as the county seat. Small towns like Mayville are hardworkingeven although they’re not huge. The demand for services shared has grown and efficiency has increased.

Chautauqua County adopted the county-wide sharing service plan for sharing services across the county. It gave priority to projects with low hanging fruit. These initiatives have a huge impact on the municipalities. In the first year the plan will save the county $1 million.

Each county has a shared services panel thanks to the county-wide shared services initiative. The panel has the responsibility to collaborate with the executive to develop and the implementation of a local sharing services strategy.