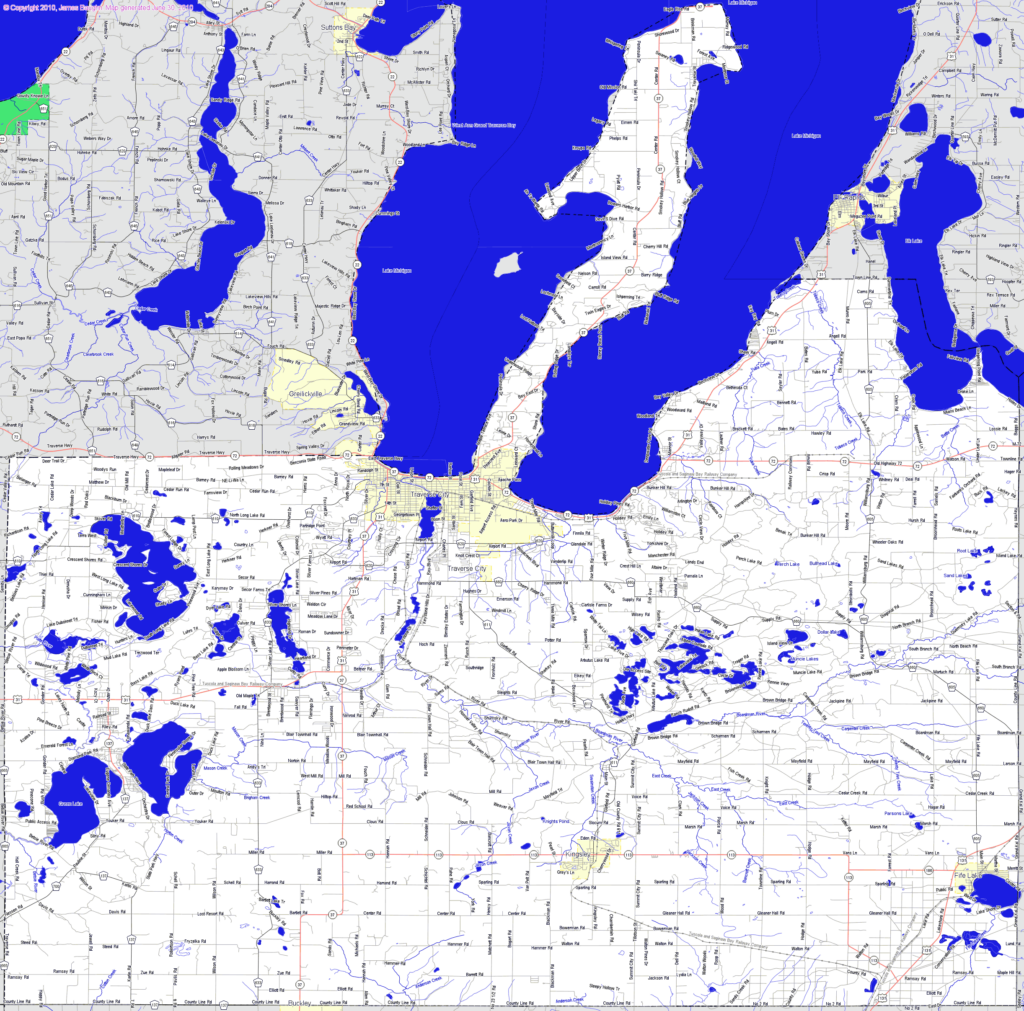

Grand Traverse County Tax Map – If you’re a property proprietor or an owner of a business and are aware of how vital it is to use an official county map for tax purposes. It is crucial to understand how parcel mapping works on a tax map of the county. This will allow you to make timely tax payments, and keep your property’s value.

Map of cadastral tracts

It is vital for the assessment of real estate that the parcel mapping be done in Cadastral. It assists the assessor in locating every parcel and issuing it with a Parcelle Identification Number.

This is done by finding out what the dimensions of the parcel are, the way it was laid out and where it will be put in. This map shows the connection between the parcels. The plots can be taxed (or exempt).

During the tax mapping process the tax map is a way to determine which part of the region is tax-exempt. Each piece of taxable real estate must be listed on the tax map. The map must be updated often.

It is necessary to modify the tax map in order to change the physical dimensions or shapes of parcels. When the parcel’s number changes, adjustments are necessary.

Tax maps show the amount and whereabouts of each taxable property located within a county. Each county has tax maps for each assessor in the local area. These maps help the assessor in assembling the assessment roll.

Accuracy of county parcels

A variety of factors influence the accuracy of parcels on county tax maps. First, the data’s initial source. The information is used to create packages. A package’s information may not be current or accurate.

The accuracy of parcels displayed on maps is dependent on the map as well as the information source. Each county could have its own standards for map accuracy. Contrary to hand-drawn maps, which are still accessible in certain counties, digital mapping software will typically show more precise parcels.

The parcel information includes the assessed value of the property as well as any easements or titles that are associated with it. This is the data most requested by counties. All information is in one place and is easy for residents and businesses to find. This boosts efficiency.

There is a way to make use of county parcel data to aid in economic development. You can use the information of a parcel to plan taxes, planning, emergency response, and many other purposes.

Tax Map of Sullivan County

The Sullivan County Tax Map has an unique format for PDF that opens in your preferred browser. It is also printed available at the Sullivan County Real Property Services Office. It can take a specific amount of time to load a file, based on the size of the file.

The Sullivan County Tax Map should be used as a reference. Along with waterways and highways It also includes state parks, forests, and game lands. For a more precise map of your property, check the tax parcel book of your county. For those who are in search of more maps an upgrade service is available.

The Sullivan County Tax Map does not have a formal title. You can submit the required request to the County Real Property Tax Service as well as the Sullivan County Clerk. The Clerk, in addition to other tasks, is accountable for registering deeds.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. There are six farms, six lakes and the food processing area. The county’s center is located where Chautauqua Lake flows into the Gulf of Mexico.

The Eastern Continental Divide traverses the region. It flows into Conewango Creek. The lake is a source of water for villages within the area, even though it’s only 25 miles from open water.

Chautauqua County has fifteen communities. Mayville is the county’s seat. Small towns like Mayville are hardworking, although they’re not huge. There is a growth in efficiency and demand for services shared.

The county-wide shared service plan, which gave low hanging fruit projects the highest priority to be implemented by Chautauqua County. The initiatives will have a major impact on local governments. The plan anticipates saving the county over 1 million dollars within the first year following its implementation.

With the help of the countywide shared services program, every county now has a shared panel of service. The panel is accountable for working with the executive to create and implement a local shared services strategy.