Lafayette County Tax Map – If you’re a property owner, or a company owner and are aware of how important it is to have a county map to help with tax planning. Learning how to utilize a the parcel map, which is an essential element of the tax map for counties, will assist you pay your taxes in time and preserve the value.

The mapping of parcels of cadastral land

It is essential to assess the value of real estate properties that parcel mapping be carried out in Cadastral. It helps the assessor locate every parcel and then issue it with a Parcel Identification number.

This is done by taking note of what the dimensions of the parcel are, the way it was laid out and the location it is put in. The map then shows the connections between the parcels and other parcels. The plots may be taxed or exempt.

During the tax mapping process it is decided the part of the area that will be subject to tax. Every piece of taxable property must be included on the tax map. It is essential to update the map regularly.

Modifying the tax map is needed to alter the physical dimensions of the parcel. If the shape or number of parcels changes then it’s necessary to update the map.

Tax maps will indicate the location and value of each property is located within a given county. Every county provides tax maps for each local assessor. They are intended to aid the assessor in creating the assessment roll.

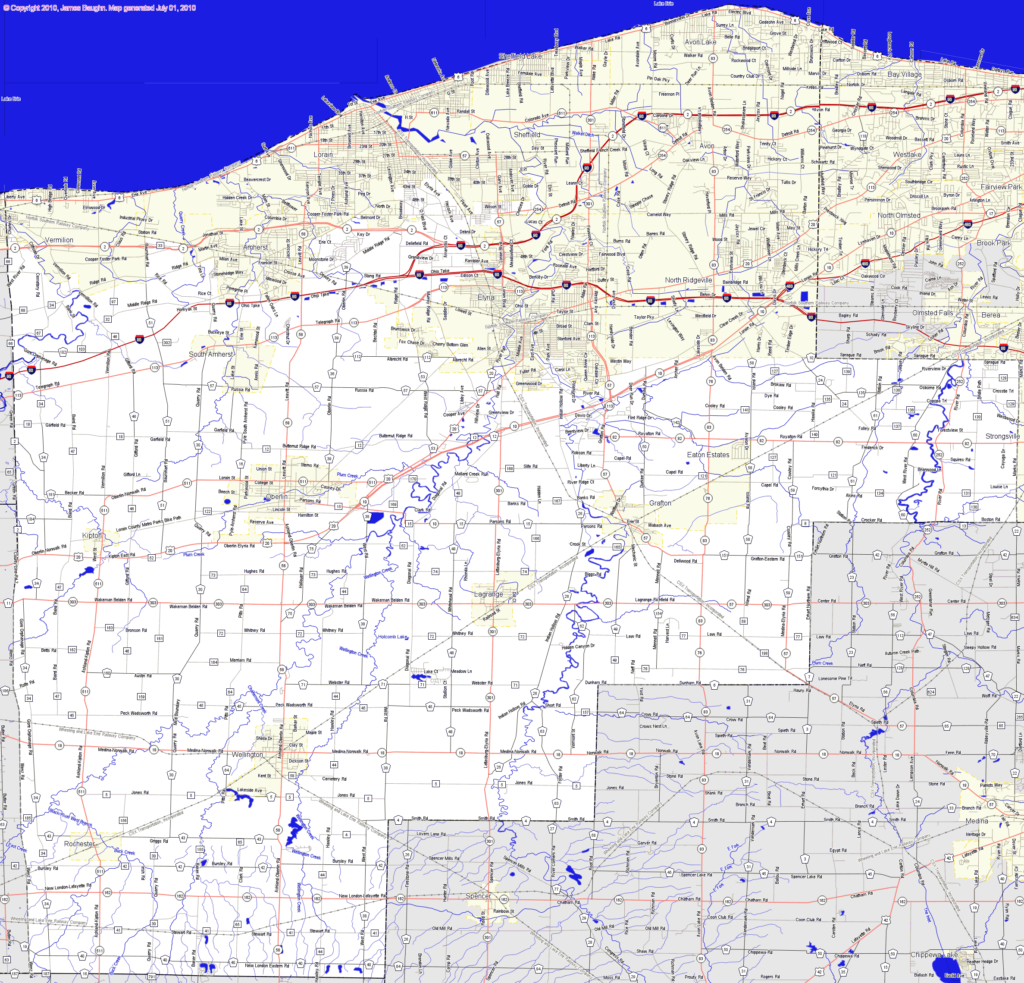

The accuracy of county parcels

Many factors affect the exactness of parcels displayed on county tax maps. first, the original source. You can use survey results, deeds, and subdivision plans to create parcels. It is possible for information on a document to be inaccurate or out of date.

The accuracy of the parcels on the map is dependent on the map as well as the information source. This is the reason why different counties have different requirements regarding accuracy on maps. A solid, established digital mapping application will usually show more precise parcels than hand-drawn maps.

All data that is included, including the assessed value of the property, as well as any easements or titles that relate to it are included in the parcel’s data. It is the most common information requested by counties. It’s simple to get all the data you require that increases the productivity of both residents and businesses.

In reality, the county parcel data could be utilized as a tool for economic development. The data from a parcel can be used for tax assessment planning, planning, or even emergencies.

Tax Maps for Sullivan County

The Sullivan County Tax Map, that is a PDF document which can be opened with any browser that you prefer it’s a beast. The printed version is available at the Sullivan County Real Property Services Office. The file’s size will determine how long it will take to load.

As a guide for a map, as a guideline, the Sullivan County Tax Map is recommended. It covers waterways, highways, forests, and state parks. To get a more accurate map of your property, check the tax parcel book for your county. The premium service is designed for people who need a lot of maps.

The Sullivan County Tax Map does not have a formal name. You can submit your request to the County Real Property Tax Service and the Sullivan County Clerk. This office is responsible in addition to other duties, for registering deeds.

Tax Maps of Chautauqua County

Chautauqua County allows westward entry to New York State. The county has six lakes in the county, agricultural land, as well as the food processing industry. The county’s middle is the home of Chautauqua Lake. It eventually runs into Gulf of Mexico.

The Eastern Continental Divide traverses the region. It flows into Conewango Creek. The lake provides water to villages located in the area, even though it’s only 25 miles away from the open water.

Chautauqua County contains fifteen communities. Mayville is the county’s seat. These small towns are hardworking and are very small. There is a growth in efficiency as well as demand for shared services.

Chautauqua County established the countywide shared services plan for shared services across the county. It gave the lowest-hanging fruit the top priority. These initiatives have a huge impact on the local governments. In the first year, the strategy will reduce the cost of the county by $1 million.

The county-wide shared service program has established a panel of shared services for each county. The panel’s responsibility is to work with the executive on developing and implementing a local shared services strategy.