Lauderdale County Al Tax Maps – If you are a property or business owner, it’s essential that you use the tax map for your county. Learning how to utilize parcel mapping, which is a vital element of a tax map, will help you make timely tax payments and preserve the value of your property.

Cartografting of cadastral parcels

Cadastral parcel mapping is essential in the assessment of real property. It assists the assessor in finding every parcel of real estate , and issuing a Parcel Identification Num.

This is done by taking note of what the dimensions of the parcel are, how it was laid out and the location it is put in. The map will then show the connection between each parcel and the other parcels. These plots may be exempt or taxed.

Tax mapping is the process by which the entire tax map is drawn. Each piece of property must be identified on the taxmap. The map must be kept up-to-date regularly.

It is essential to alter the tax map in order to change the physical dimensions, or the forms of parcels. In addition, if the size of parcels is changing, a revision may be required.

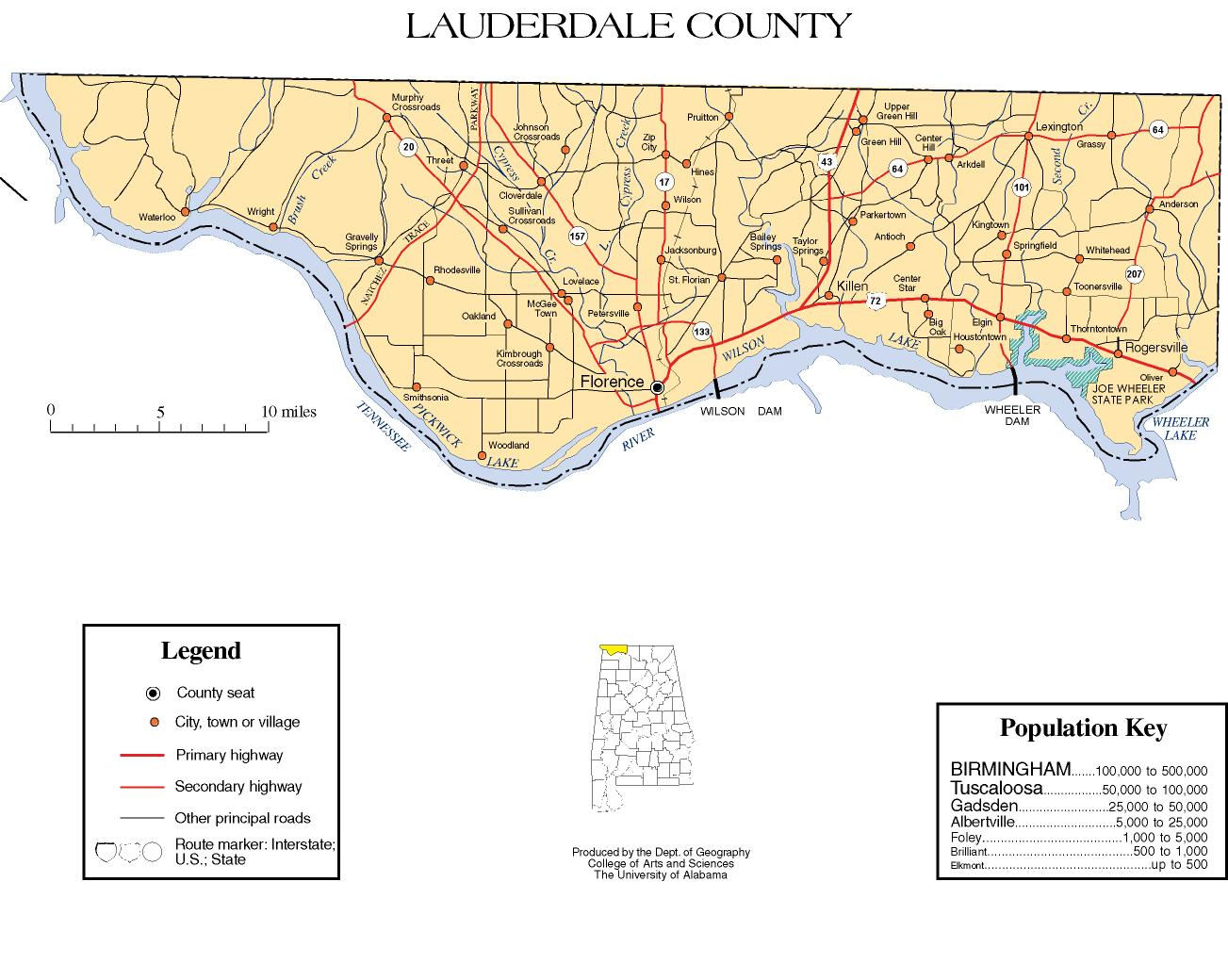

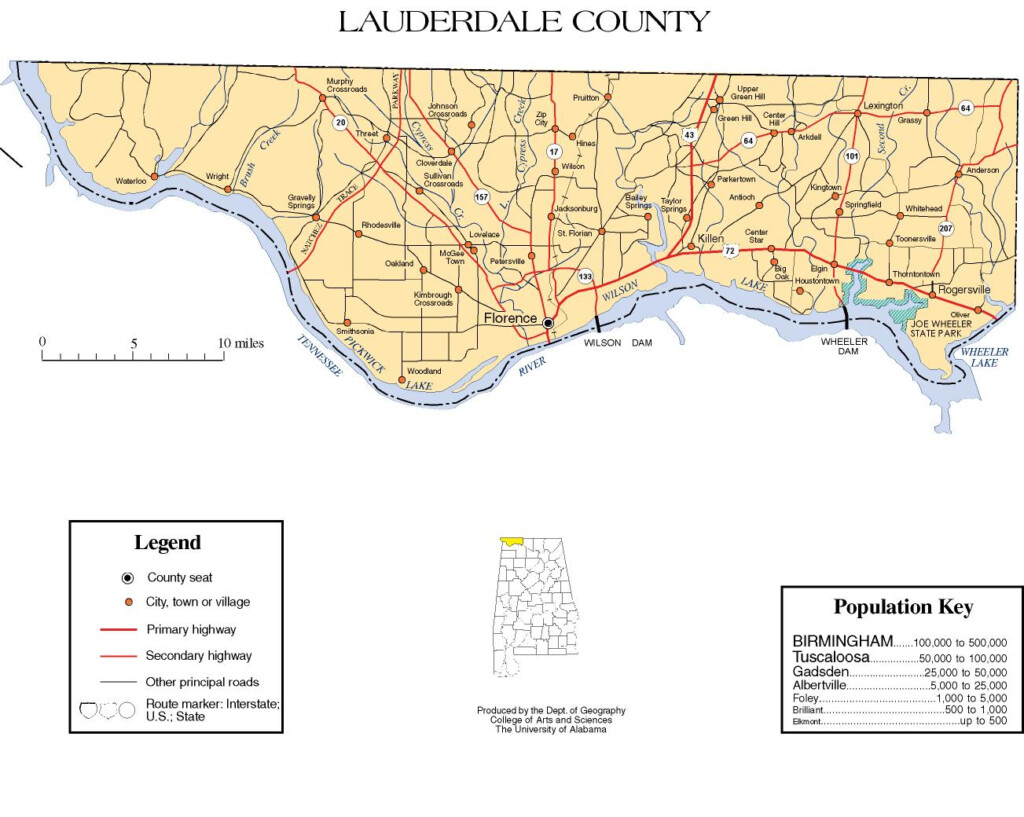

Tax maps show the value and location of each taxable property located within a county. Every county gives tax maps to the assessor in their area. They assist in the preparation of the assessment rolls.

Accuracy of the county parcels

There are a variety of factors that affect the accuracy of tax maps for counties. first, the information’s original source. Deeds, subdivision plans and survey results could be combined to create parcels. This could result in inaccurate or obsolete information.

The accuracy of parcels displayed on an image is determined by the map and its information source. Each county could have its own standards for map accuracy. In contrast to maps drawn by hand, which are still accessible in some counties, digital mapping applications will often show more accurate parcels.

The parcel information includes the assessed valuation of the property, as well as any easements and titles associated with it. This is the most important information sought by counties. It is simple to locate everything in one location, which boosts productivity for residents and enterprises.

In actuality the county parcel information is an effective tool for economic development. The information about a property can be used to plan and assess tax or even respond to an emergency.

Tax Map for Sullivan County

It is an Adobe PDF file that can be opened in the browser you prefer The Sullivan County Tax Map is a bit of a beast. A printed version is also available from the Sullivan County Real Property Services Office. The time required to load a file is contingent on the size of the file.

As a guideline, for a reference, Sullivan County Tax Map is suggested. It contains waterways, highways forests, state parks. To get a more precise plan of your home, check your county tax parcel books. If you’re seeking additional maps, you can avail an option to purchase a premium service.

The Sullivan County Tax Map has no formal name. You can request the information to the Sullivan County Clerk or the County Real Property Tax Service. The clerk is responsible of registering deeds as well as managing the tax map review program in addition to other responsibilities.

Tax Maps for Chautauqua County

Chautauqua County is the only route to gain westward access to New York State. There are six lakes in the county, farms, as well as the food processing industry. The county’s center is located where Chautauqua Lake flows into the Gulf of Mexico.

The Eastern Continental Divide passes through this region. It drains into Conewango Creek. Even though there’s only one spot within the county that is more than 25 miles from open water, Conewango Lake is a substantial drinking water to the communities within it.

Chautauqua County has fifteen communities. Mayville is the county seat. These small towns are hardworkingeven however they’re not big. There are many shared services, which has resulted in increased efficiency.

Chautauqua County established the countywide shared services plan for shared services across the county. It gives low-hanging fruits project the top priority. These initiatives have significant impacts on municipalities. This strategy is projected to save the county more that $1 million within the first year.

Thanks to the county-wide sharing services initiative, every county now has their own shared services panel. It is the responsibility of the panel to work in conjunction with the executive in creating and implementing a local shared services strategy.