Lincoln County Tax Assessor Maps – If you are a property or business owner, it is essential to use a county’s tax map. You can make timely tax payments and protect the worth of your home by understanding how to use parcel mapping.

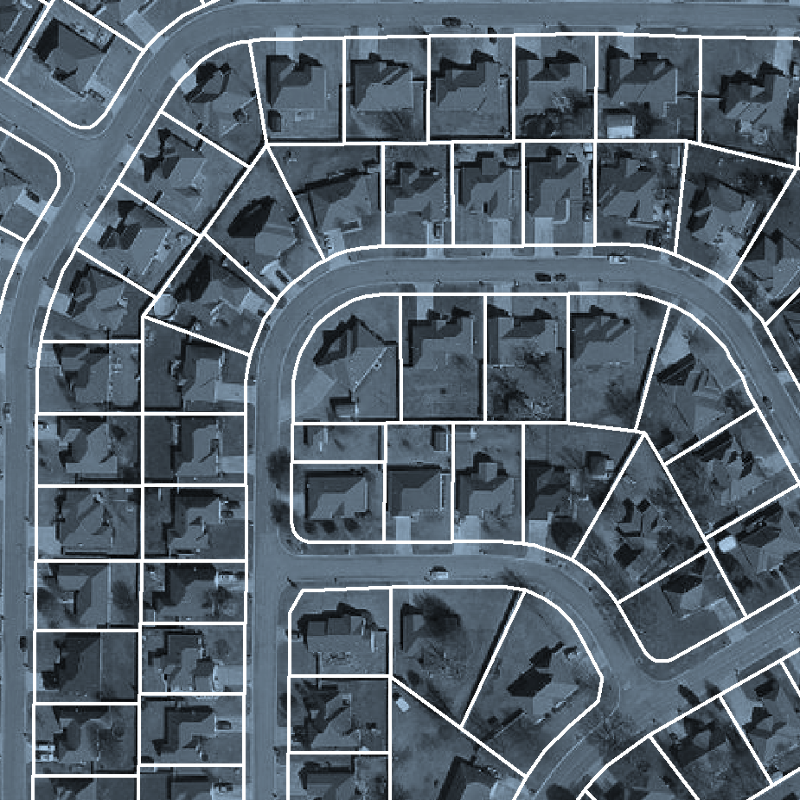

Cartography of the cadastral parcels

It is essential to assess the value of real estate that parcel mapping is done in Cadastral. It allows the assessor to identify each parcel and then issue it with a Parcle Identification Number.

This is done by determining the parcel’s dimensions, form, and placement. The map then shows the link between each parcel and the other parcels. The plots may be exempt or taxed.

The entire area that will be taxed is established throughout the tax mapping process. Every property subject to taxation is required to be shown on an tax map. The map should be updated often.

The modification of the tax map is required to alter the physical dimensions of the parcel. Also, changes in the number and shape of parcels require modifications.

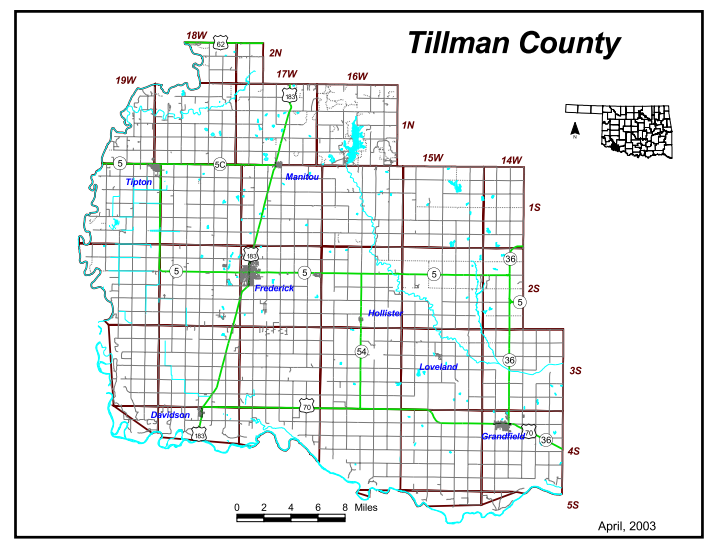

Tax maps show where and how much each property is located in the particular county. Each county has tax maps available to the local assessor. They aid in the creation of the rolls of assessment.

Accuracy of parcels in the county

Many variables could influence the accuracy shown on tax maps of counties. The first is the source of the information. Deeds and subdivision plans and survey results may all be used to create parcels. The information on a package may not be current or accurate.

The precision of the areas in the map is dependent on the map as well as the source of information. That’s why some counties have different requirements regarding map accuracy. Contrary to hand-drawn maps, which are still accessible in some counties, digital mapping applications will often show more accurate parcels.

The parcel data contains the assessed value for each property, as well as any easements and titles that are attached. This is the most requested information by counties. Everything being in one place makes it easy to access, which enhances the productivity of both residents and enterprises.

County parcel information could be an important economic development tool. A parcel’s information can be used to plan taxes, planning, and even for emergency response.

Tax Map for Sullivan County

The Sullivan County Tax Map is large PDF file that can be viewed using any browser. The printed version is available at the Sullivan County Real Property Services Office. The size of the file will affect the amount of time required to download it.

Make use of the Sullivan County Tax Map as a guide. It is a map of roads, rivers, forests, as well as game land. You can find an exact map of your property in the book of tax parcels for the county. Premium service is for people who need a lot of maps.

The Sullivan County Tax Map has no formal title. It is possible to ask for the information to the Sullivan County Clerk or the County Real Property Tax Service. The Clerk is responsible for the registration of deeds, overseeing an application to look over tax maps, and other functions.

Tax Maps for Chautauqua County

Chautauqua County provides westward access to New York State. There are six lakes, farmland, as well as the food processing area. The middle of the county is the home of Chautauqua Lake. It eventually empties into Gulf of Mexico.

The Eastern Continental Divide cuts through the region. It flows into Conewango Creek. The lake provides drinking water to the villages around, despite the fact it is less than 25 miles away from the closest open source of water.

Chautauqua County has fifteen communities. Mayville serves as the county seat. The towns are small, but efficient. There is a growth in efficiency and demand for shared services.

Chautauqua County established the countywide shared services plan for shared services across the county. It gives low-hanging fruits projects priority. These initiatives have a significant impact on local government. This plan could save the county over one million dollars in the first year.

Each county now has a shared services panel thanks to the county-wide shared services initiative. The panel has the responsibility to work closely with the executive in establishing and the implementation of a local sharing services strategy.