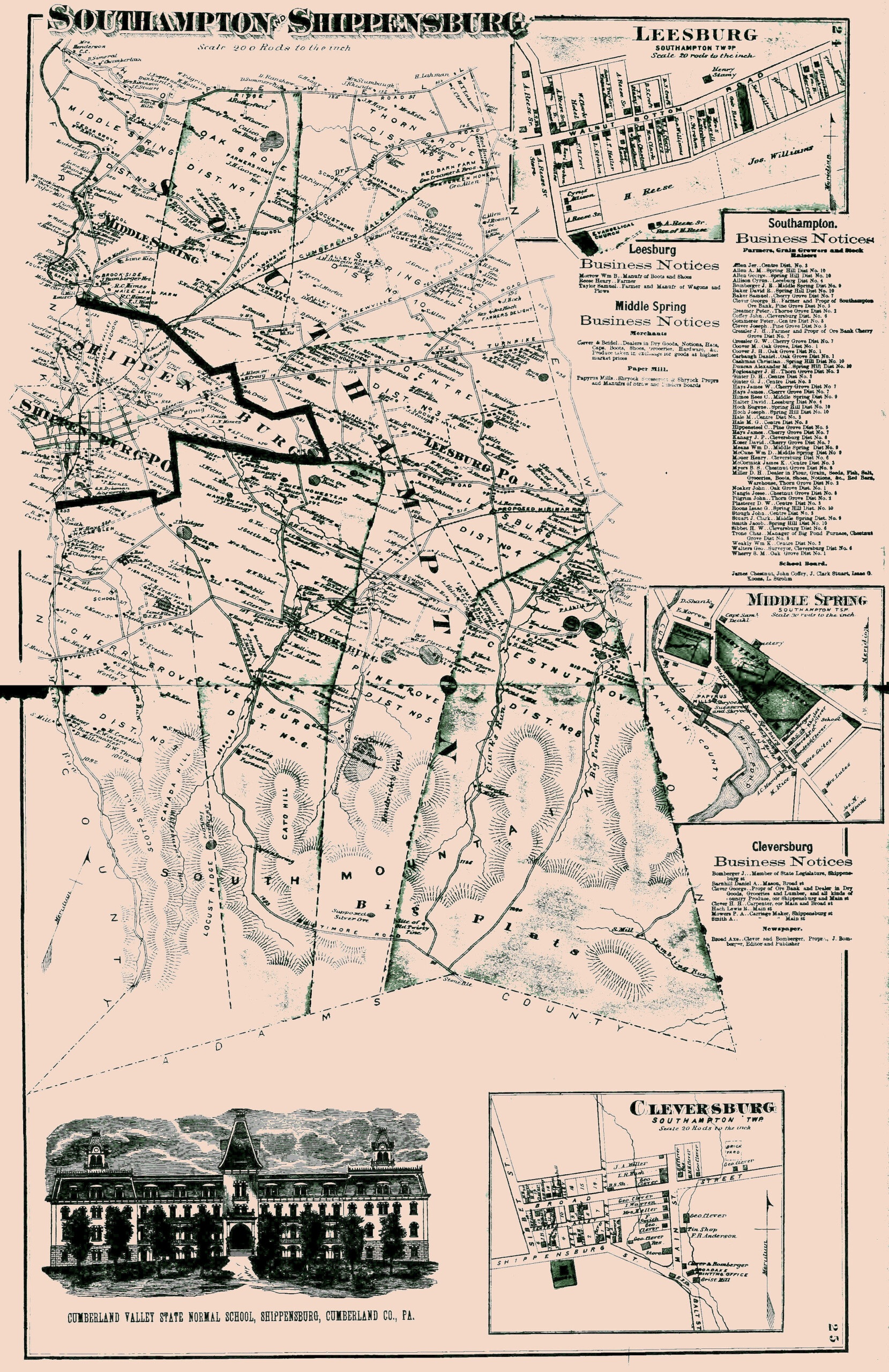

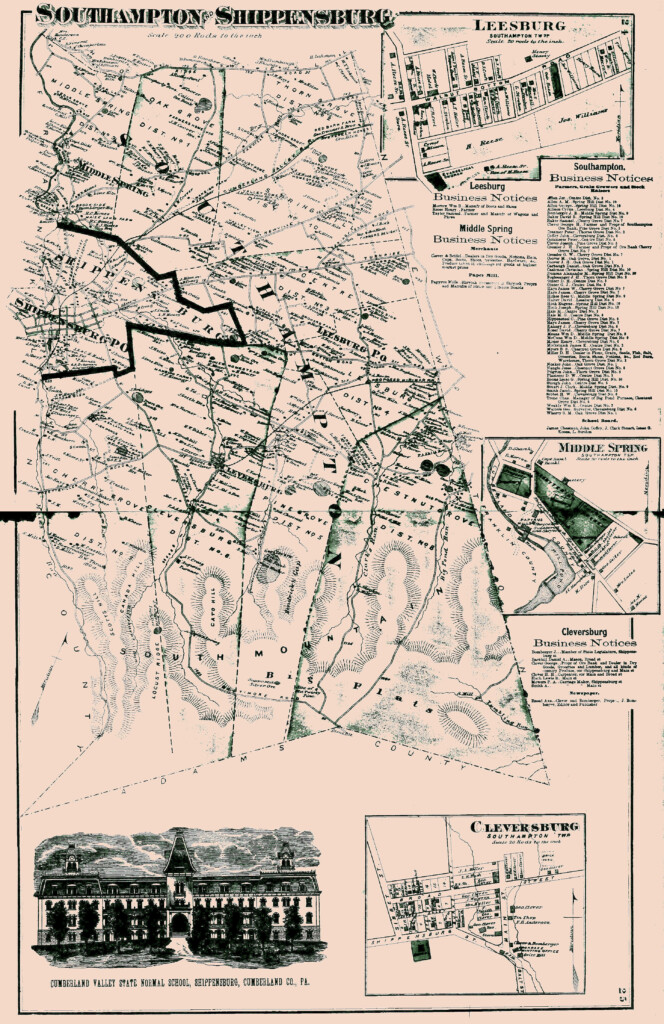

Monroe County Pa Tax Map – If you’re a property or company owner, it is essential that you use the tax map for your county. It is crucial to understand how parcel mapping functions on a tax map of the county. This will enable you to make timely tax payments, and keep your property’s worth.

The mapping of parcels of cadastral land

Cadastral parcel mapping is crucial in the assessment and management of real estate. It helps the assessor locate every parcel and then issue it with the Parcel Identification number.

This is done by determining what the parcel’s dimensions are, how the parcel was laid out, and then where it is placed. The connection between the parcel and other parcels are displayed on the map. These plots could be exempt or taxed.

During the tax mapping procedure the entire territory which will be taxed has been identified. Every property subject to taxation must appear on the tax map. The map should be updated often.

The physical dimensions of a parcel or form must be updated, which necessitates modifying the tax map. If the number or shape of parcels changes then it’s necessary to make revisions.

Tax maps will indicate how much and where each property is situated in a given county. Every local assessor gets tax maps from their county. They are intended to aid the assessor in putting together the roll of assessment.

The exactness of county parcels

There are a variety of variables which affect the accuracy and accuracy of the parcels on the tax map of the county. first, the information’s original source. Deeds, subdivision plans, and survey results could all be used to create parcels. It is possible for information in a parcel to be inaccurate or out of date.

The accuracy and completeness of the areas shown on maps are dependent on the source information, as well as the map. There could be different requirements for accuracy in maps across counties. Contrary to the hand-drawn maps, which are accessible in some counties, an established, reliable digital mapping program will generally show more accurate parcels.

The parcel information includes the assessed value of the property along with any easements and titles associated with it. This is the data most sought by counties. The convenience of everything being all in one location increases the efficiency of both residents and enterprises.

In reality, county parcel data is an important tool for economic development. The information about a parcel can be utilized for planning tax assessment, as well as even for emergency response.

Tax Map of Sullivan County

The Sullivan County Tax Map has an unique format for PDF that is accessible in your preferred browser. For those who would like an actual copy it is possible to print one at the Sullivan County Real Property Services Office. It takes a certain amount of time to download the file, depending on the size.

Make use of the Sullivan County Tax Map as an aid. Along with waterways and highways as well as state parks, forests and game land. A more precise map of the property is available within your county tax parcel. If you are looking for additional maps, you can avail a paid service available.

The Sullivan County Tax Map does not have a formal title. You can make the necessary request to the County Real Property Tax Service as well as the Sullivan County Clerk. The clerk, in addition to various other duties, is accountable for the registration of deeds and also overseeing the tax map review program.

Tax Maps for Chautauqua County

Chautauqua County is the only route to gain westward access into New York State. Six lakes, farms, and the food processing sector are all situated in the county. The county’s central point is where Chautauqua Lake flows into the Gulf of Mexico.

The region is bordered by the Eastern Continental Divide. It flows into Conewango Creek. The lake supplies drinking water to the villages around, despite the fact it is just 25 miles away from the closest open source of water.

There are fifteen communities in Chautauqua County. Mayville is the county seat. These towns are small but efficient. Services that are shared have been highly searched for, and efficiency has grown.

Chautauqua County established the countywide shared services plan. It gives low-hanging fruits the top the top priority. The initiatives have a significant impact on local governments. This plan could save the county more that one million dollars in the first year.

Each county now has a panel across the county for shared services thanks to the county’s shared services initiative. The panel is accountable for working together with the executive in the creation and implement a local shared service strategy.