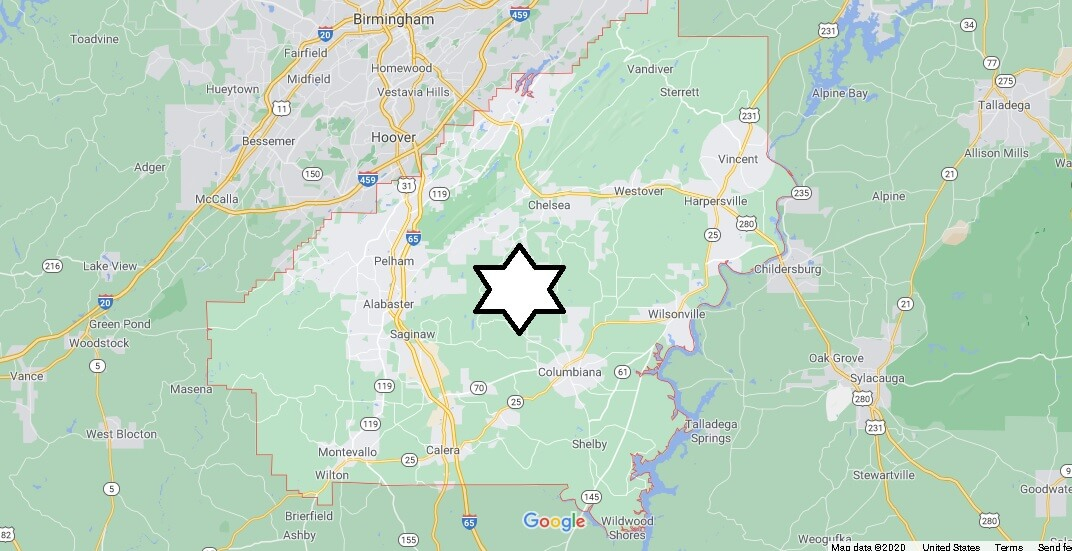

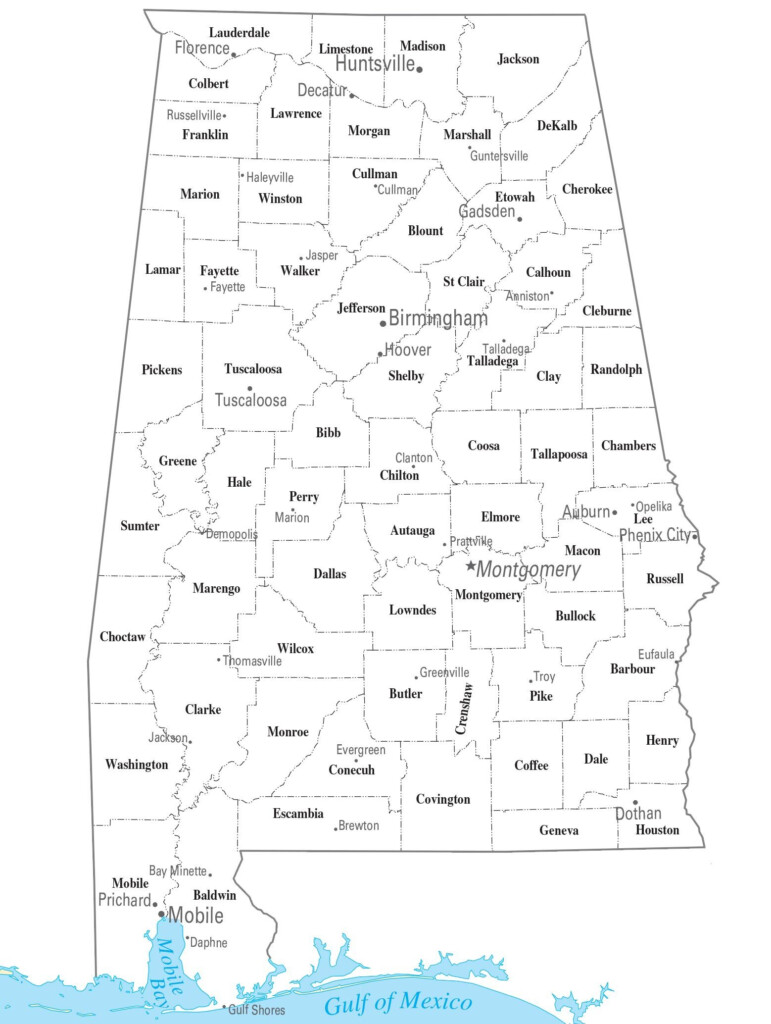

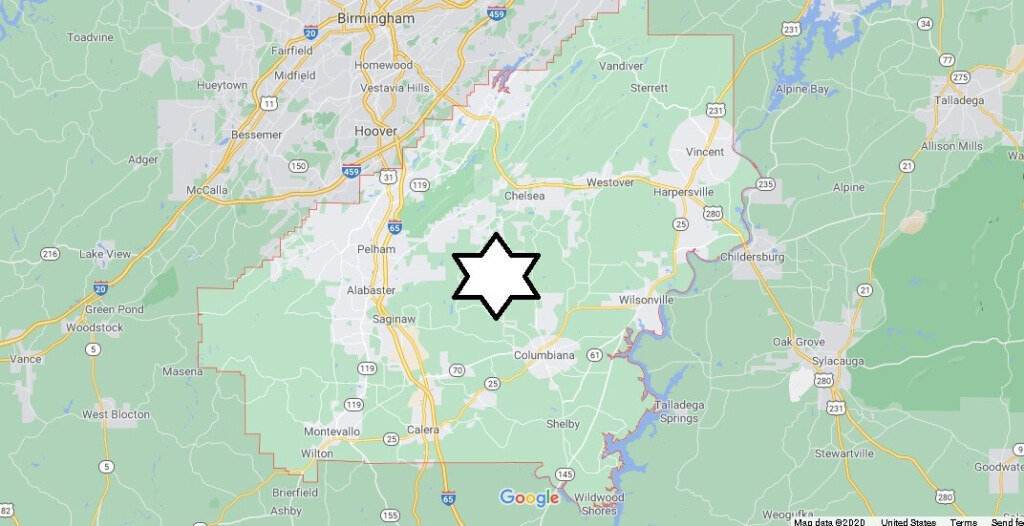

Shelby County Alabama Tax Map – If you’re a homeowner or an owner of a business or a business owner, you must be aware of how important it is to have a county map for tax purposes. It’s possible to timely pay tax payments and maintain the value of your property by learning how to utilize parcel mapping.

Map of the cadastral tracts

Cadastral parcel mapping is critical for the evaluation and management of real estate. It aids the assessor in locating each parcel and issuing it with an Identification Number.

This is accomplished by taking note of what the dimensions of the parcel are, the way the parcel was laid out, and the location it is put in. This map shows the relationship between the parcels. These plots can be taxed or exempt from taxation.

During the tax mapping process, it is determined the part of the area that will be subject to tax. Each piece of property must be identified on the taxmap. It is important to keep the map updated.

The tax map also needs to be updated to reflect changes in the physical dimensions and shape of a parcel. In addition, if the size of parcels is changing, revisions might be required.

Tax maps show the amount and whereabouts of each tax-paying property within a particular county. Every county provides tax maps for each local assessor. These maps help the assessor with assembling the assessment roll.

Accuracy of the county parcels

Numerous variables can affect the accuracy of county tax maps. The first is the source. Deeds, subdivision plans, and survey results can be combined to create parcels. Sometimes, the information contained in a package might be incorrect or out-of-date.

The accuracy or lack of accuracy of a particular parcel on a map is determined by its content as well as the source of the information. Each county may have their own requirements regarding map accuracy. A solid, established digital mapping application will usually show more precise parcels than hand-drawn maps.

The entire data which includes the value assessed for the property and any easements or titles that relate to it are part of the parcel data. This is among the most sought-after information requested by counties. It is easy to locate all the data you require that increases the productivity of both residents as well as businesses.

The county parcel information can be utilized as an instrument for economic development. The data about the parcel is useful to plan tax assessments, planning as well as emergency response.

Tax Map for Sullivan County

The Sullivan County Tax Map is an enormous PDF file that is able to be opened by any browser. For those who prefer printing copies it is possible to print one obtained at the Sullivan County Real Property Services Office. The file’s size will determine how long it takes to load.

Make use of the Sullivan County Tax Map as an aid. It includes waterways and roads aswell as forests, state parks and game lands. Consult your county tax parcel book for more exact maps of your property. Premium service is available for those who need more maps.

The Sullivan County Tax Map does not have a formal name. But, you are able to make the necessary request to the County Real Property Tax Service and the Sullivan County Clerk. The clerk is also responsible, among other things for the registration of deeds.

Tax Maps for Chautauqua County

Access to the west of New York State is provided through Chautauqua County. Six lakes, farmland, as well as the food processing industry are all situated there. The county’s central area is where Chautauqua Lake can be found that eventually drains into the Gulf of Mexico.

The Eastern Continental Divide runs through the region. It drains into Conewango Creek. The lake provides drinking water to the villages that surround it, despite the fact that it is situated less than 25 miles from the closest open source of water.

There are 15 communities within Chautauqua County. Mayville serves as the county seat. The towns are small, but active. Demand for services shared has grown and efficiency has improved.

The county-wide shared services plan, which gave low-hanging fruit projects the top priority, was enacted by Chautauqua County. Municipalities are significantly impacted by these initiatives. In the initial year the strategy is anticipated to save the county over 1 million dollars.

Through the county-wide shared services program, every county now has an established shared panel for service. The panel has the obligation to collaborate with the executive in establishing and developing a local sharing service strategy.