Suffolk County Real Property Tax Map – A county tax map is essential for both business and property owners. Understanding how to use parcel mapping, an essential element of a county’s tax map, can help you pay your taxes on time and preserve the value of your property.

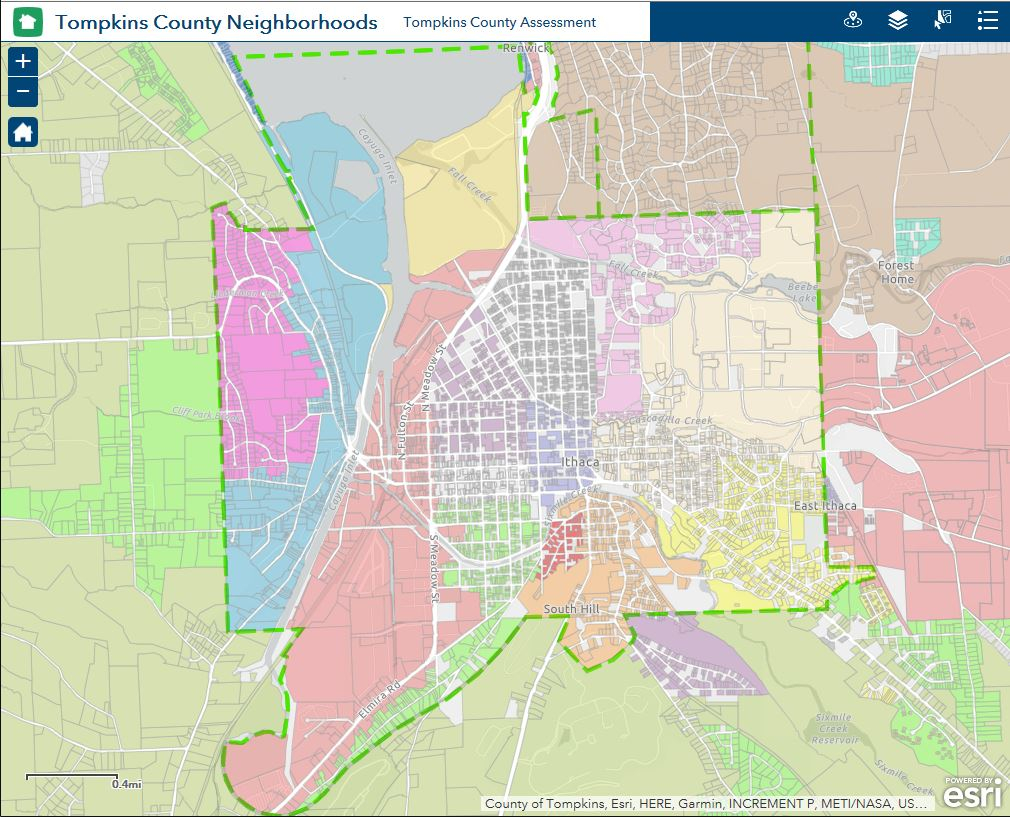

The mapping of parcels of cadastral land

The assessment of real estate is made simpler by the cadastral mapping of parcels. It aids the assessor in locating every parcel and issuing it with a Parcelle Identification Number.

This is accomplished by finding out what the dimensions of the parcel are, the way it was laid out and the location it is located. The map then shows the connections between each parcel and the other parcels. These plots can be tax-free or exempt.

During the tax mapping procedure, the whole area that will be taxed has been determined. Each piece of property must be identified on the tax map. It is essential to update the map regularly.

Modifying the tax map is required to alter the physical dimensions of the parcel. Furthermore, changes in the number and shape of parcels require modifications.

Tax maps will indicate how much and where each property is situated in a given county. Each county has tax maps for each assessor in the local area. They are designed to assist the assessor in putting together the roll of assessment.

The accuracy of county parcels

Many variables affect the accuracy of tax maps for counties. The first is the source. Survey results, deeds, or subdivision plans to make parcels. It is possible for the information on a package to be out of date or incorrect.

The accuracy of the parcels in a map depends on both the map and the source of information. Each county may have their own standards for map accuracy. In contrast to hand-drawn maps, which are accessible in some counties, an established, reliable digital mapping software will usually show more accurate parcels.

The entire data which includes the value assessed for the property as well as any titles or easements that are related to it are included in the parcel data. It is the information that counties frequently request. It is easy to find all the information in one place, which boosts productivity for residents and enterprises.

It is possible to make use of data from county parcels for economic development. It is possible to use the data of a parcel to plan taxes, planning, emergencies, and for other purposes.

Tax Map of Sullivan County

The Sullivan County Tax Map is a huge PDF file that is able to be opened in any browser. A printout of the Sullivan County Real Property Services Office is available to people who would like to get an actual copy. The time needed to load a file will be contingent on its size.

Make use of the Sullivan County Tax Map as an aid. The map contains waterways and roads aswell as state parks, forests and game land. Look up your county tax parcel book to get a more exact maps of your property. Premium service is available to people who require several maps.

The Sullivan County Tax Map is not officially designated, however you can send the required requests to the Sullivan County Clerk’s Office and the County Real Property Tax Service. The clerk is responsible for, among other things to register deeds.

Tax Maps for Chautauqua County

Chautauqua County allows westward entry into New York State. The county has six lakes in the county, agricultural land, and the food processing industry. In the middle of the county is Chautauqua Lake which eventually flows into the Gulf of Mexico.

The Eastern Continental Divide runs through the region. It drains into Conewango Creek. Even though there is only one location in the county that is over 25 miles from open water, Conewango Lake supplies an important supply of drinking water to the communities around it.

Chautauqua County has fifteen communities. Mayville is the county seat. These small towns are hardworking and are comparatively small. The demand for services shared has grown and efficiency has improved.

The county-wide shared services plan, which granted low-hanging fruit projects priority to be implemented by Chautauqua County. These initiatives are a major benefit to municipalities. The county could be able to save more than $1 million during the first year it is in being in operation.

Every county has a panel across the county for shared services thanks to the county’s shared service initiative. It is the duty of the panel to collaborate with the executive on the creation and implementation of the local share services strategy.