Suffolk County Tax Map – A tax map for the county is vital for both business and property owners. The most important element of tax map for a county is the parcel map, is crucial to ensure timely tax payments. It will also help to maintain the property’s value.

The mapping of cadastral parcels

Cadastral parcel mapping is essential to the management and evaluation of real estate. It aids the assessor to locate each parcel and provide it with a Parcel Identification number.

This is accomplished by using the parcel’s form, dimensions as well as its location. On the map, connections between the parcels and other parcels can be identified. The plots could be exempt or taxed.

In the tax mapping process the entire territory that will be taxed has been determined. Every piece of taxable property is required to be shown on an tax map. It is crucial to keep the map updated.

The tax map also needs to be modified to reflect changes to the physical dimensions and form of the parcel. If the number of parcels has changed, then revisions may be required.

A tax map will show the location and value of each property is located in the county. Each county provides tax maps to the assessor in their area. They assist the assessor in prepare the assessment roll.

The accuracy of the county parcels

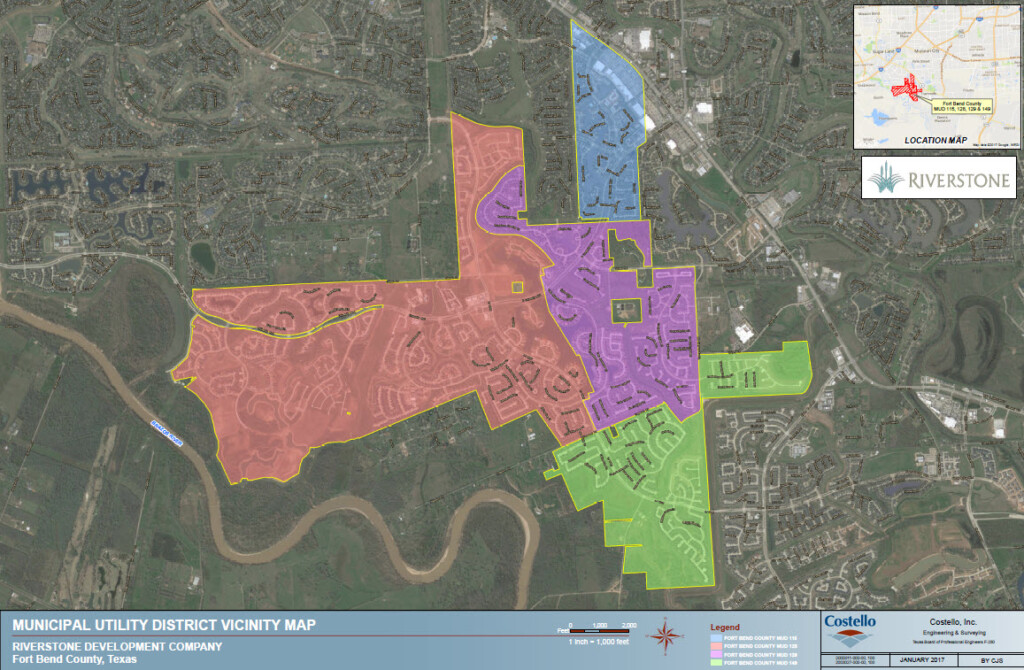

The accuracy of the parcels depicted on tax maps of the county is influenced by a number of factors. The first is the source. It is possible to construct parcels using survey data and subdivision plans, deeds and even deeds. The information on a package may therefore be insufficient or out of date.

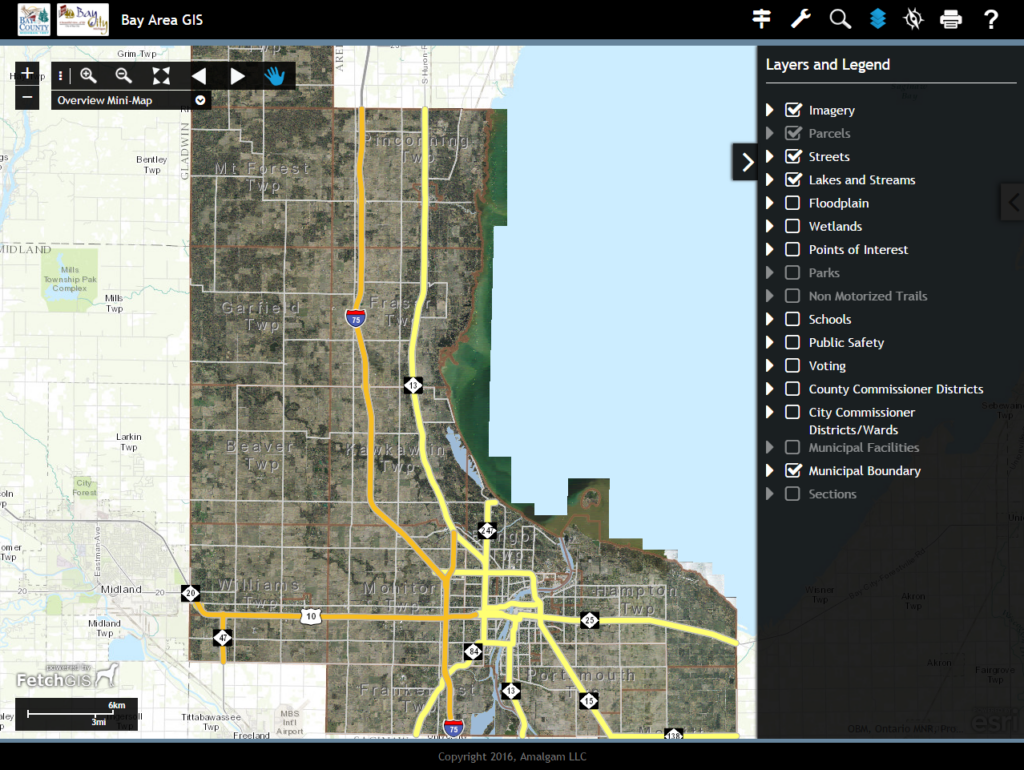

The accuracy and completeness of the parcels shown on a map depend on the source information, as well as the map. Every county has their specific requirements for accuracy of maps. Instead of the hand-drawn maps that can still be found in certain counties but isn’t always readily available, a well-established digital mapping software will generally show more accurate parcels.

All information that is included, including the value assessed for the property as well as any titles or easements that are related to it, is included in the data for the parcel. This is the most important information sought by counties. The convenience of everything being all in one location increases the efficiency of both the residents and businesses.

In fact the data from county parcels can be used as a tool for economic development. The data from a parcel can be used to determine tax assessments planning, planning, or even emergency response.

Tax Map of Sullivan County

It is a PDF file that can be opened within your browser. The Sullivan County Tax Map can be quite a monster. A printed version is also available from the Sullivan County Real Property Services Office. The size of the file will determine the time it takes it to be loaded.

The Sullivan County Tax Map to assist you. This map contains waterways, highways, forests and game lands. Find the most precise maps of your property in the county tax parcels book. For those who are in search of more maps you can avail a premium service.

The Sullivan County Tax Map has no formal title. It is possible to ask for the information to the Sullivan County Clerk or the County Real Property Tax Service. The clerk is also responsible in addition to other duties, for registering deeds.

Tax Maps for Chautauqua County

Access to westward areas of New York State is provided via Chautauqua County. There are six farms, six lakes and the food processing area. In the middle of the county is Chautauqua Lake which eventually flows into the Gulf of Mexico.

The Eastern Continental Divide traverses the region. It flows into Conewango Creek. Although there is only one area in the county over 25 miles from open water, the lake provides a significant supply of drinking water to the communities within it.

The number of communities that reside in Chautauqua County is fifteen. Mayville is the county seat. These towns are small , but hardworking. There is a growth in efficiency as well as demand for services shared.

Chautauqua County enacted the county-wide shared service plan that gave priority to projects with low hanging fruit. The initiatives have a significant impact on local governments. In the first year the plan is expected to save the county nearly 1 million dollars.

Every county now has an shared services panel, thanks to the county-wide shared services initiative. The panel has the obligation to work closely with the executive in establishing and implementing a local sharing services strategy.