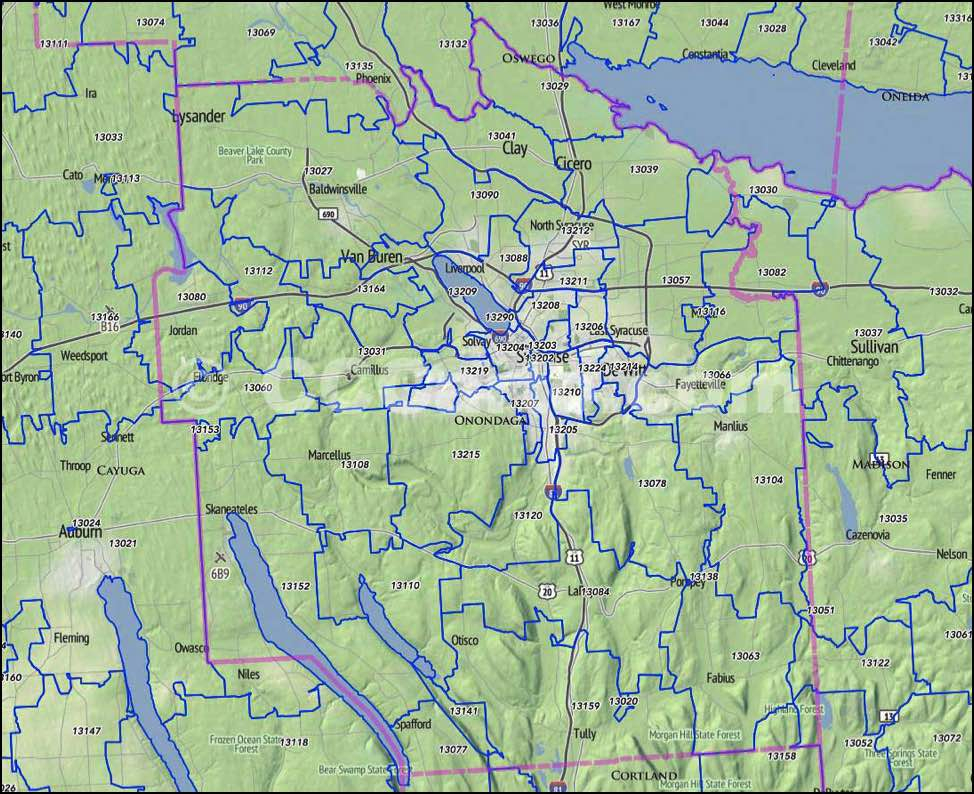

Tax Map Oswego County Ny – If you’re a property or business owner, it is essential that you utilize the tax map of your county. It is crucial to understand how parcel mapping functions on a tax map for a county. This will enable you to pay on time tax payments, and keep your property’s value.

Map of parcels belonging to cadastral owners

It is crucial to assess the value of real estate properties that parcel mapping be carried out in Cadastral. It allows the assessor to pinpoint each parcel and then issue the parcel with an Identification Number.

It is done by taking note of what the dimensions of the parcel are, the way the parcel was laid out, and where it will be located. The map shows the connection between the parcels. These plots can be taxed or exempt from taxation.

The entire area that will be taxed is determined throughout the tax mapping process. Every piece of tax-exempt real estate should be noted on the tax map. It is crucial to keep the map updated.

It is required to change the tax map in order to change the physical dimensions or shapes of parcels. If the size or number of parcels changes, it is also necessary to amend the tax map.

A tax map shows the location and the amount of all tax-exempt properties in the county. Every local assessor is provided tax maps from the county. They aid in the preparation of the rolls of assessment.

Accuracy of county parcels

A variety of factors influence the exactness of parcels shown on tax maps of counties. The source of the information is first. To make parcels, you can use deeds and subdivision plans along with survey results. It is possible for information on a document to be outdated or incomplete.

The accuracy of the parcels on maps is contingent on the map in addition to the information source. Each county may have their specific requirements for accuracy of maps. A digital mapping application that is well-established and reliable will provide you with more precise parcels, as opposed to hand-drawn ones that may be available in some counties.

The parcel data includes the assessed value for each property, as well as any easements or titles attached to it. This is the most important information requested by counties. It’s simple to get all the information you need that increases the productivity of both residents as well as companies.

The data on county parcels is an economic development tool. The information about the parcel is useful to plan, tax assessment and emergency response.

Tax Map for Sullivan County

In that it is an Adobe PDF file that can be opened in the browser you prefer The Sullivan County Tax Map is quite a monster. A printed version is also available from the Sullivan County Real Property Services Office. The amount of time needed to load a file is contingent on its size.

The Sullivan County Tax Map should be used as a reference. The map contains waterways and roads aswell as forests, state parks and game lands. A more exact plan of your property is included within your county tax parcel. If you’re seeking more maps, there is a paid service.

While the Sullivan County Tax Map lacks an official name, you can submit all the required requests to the Sullivan County Clerk’s office and the County Real Property Tax Service. This office is also responsible, among other things to register deeds.

Tax Maps for Chautauqua County

Westward access to New York State is provided via Chautauqua County. Six farms, six lakes and the food processing section. The county’s center is where Chautauqua Lake flows into the Gulf of Mexico.

The region is traversed by the Eastern Continental Divide. It drains into Conewango Creek. The lake supplies water to villages in the vicinity although it’s just 25 miles from open water.

Chautauqua County has fifteen communities. Mayville is considered the county seat. The towns in these small cities are very hard-working and are comparatively small. There are numerous shared services, which has led to increased efficiency.

Chautauqua County enacted the county-wide shared service plan which provided priority to projects that are low hanging fruit. These initiatives have a huge impact on the local governments. The county could be able to save more than $1million in the first year of its operating.

Thanks to the county-wide sharing services initiative, each county now has their individual shared services panel. It is the job of the panel members to collaborate with the executive in establishing and executing a local strategy for shared services.